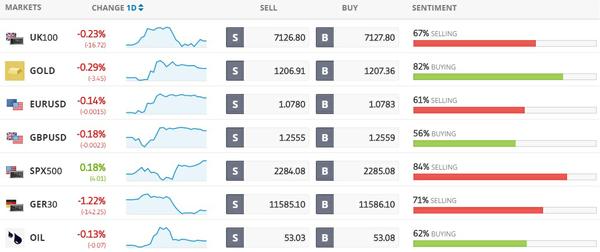

Todays Markets

|

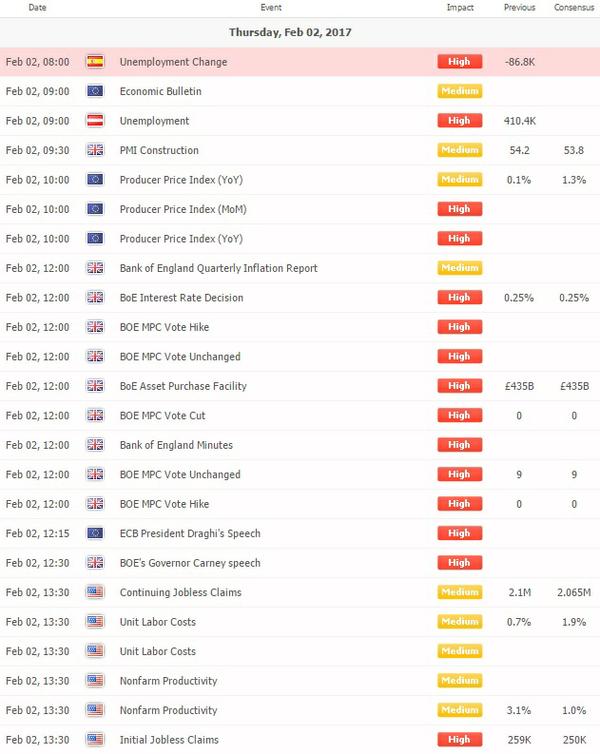

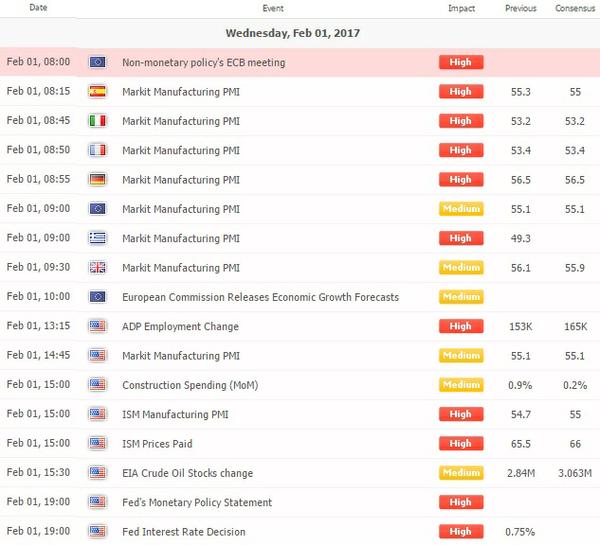

Economic Calendar (time in GMT)

|

|

|

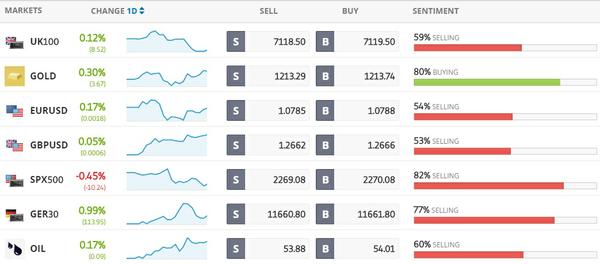

Trading Sentiment

Below is the latest sentiment as compiled by etoro, the world's largest (social) trading network. It provides a view of what individual investors think about the specific instruments and gives a view of the current sentiment.

|

|

|

Latest News Headlines

Bloomberg: Deutsche Bank Loss Narrows on Higher Revenue From Debt Trading

Deutsche Bank AG said its fourth-quarter loss narrowed as a rise in fixed income trading lifted Europe’s largest investment bank. [more...]

Bloomberg: Here's a Glimpse of the Global Trade Carnage From a U.S. Border Tax

Whether or not a border tax proposed by Republican congressional leaders helps U.S. President Donald Trump pay for his Mexico border wall, it would have a radical impact on global trade patterns. [more...]

Bloomberg: Dollar, Stocks Little Changed on Mixed Fed Signal: Markets Wrap

The latest Federal Reserve policy statement did little to alter market views on the timing for further interest-rate hikes, leaving assets from the dollar to Treasuries and stocks little changed on the day. [more...]

Bloomberg: Fed Nods to Improved Sentiment While Leaving Rates Unchanged

Federal Reserve officials left interest rates unchanged while acknowledging rising confidence among consumers and businesses following Donald Trump’s election victory. [more...]

Bloomberg: We’re in Phase III of the Trump Rally

The post-election movements of U.S. stocks have been heavily influenced by policy. First they soared, then they traded in a narrow range. Now the markets have entered a period of greater volatility. [more...] Reuters: Asian shares touch four-month high, dollar sags on Fed's relaxed views

Asian shares touched four-month highs while the dollar sagged on Thursday after the U.S. Federal Reserve stuck to its mildly upbeat economic view but gave no hint of accelerating rate hikes. [more...]

Reuters: Oil prices fall after sharp rise in U.S. stockpiles

Oil prices fell on Thursday after official data showed U.S. crude and gasoline stockpiles rose sharply, although signs that OPEC and other producers are holding the line on output cuts are helping support prices. [more...] |

|

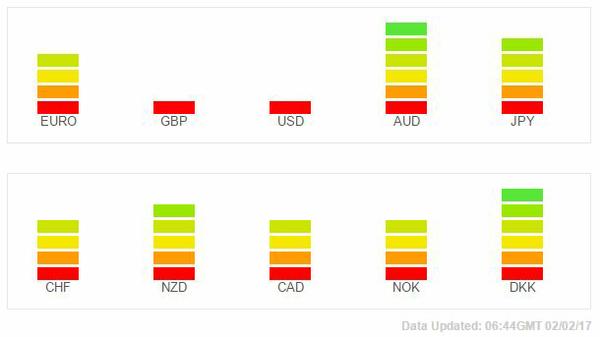

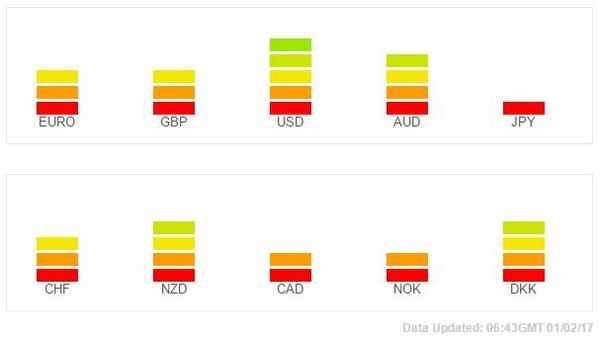

Currency Strength Indicators

|

Trade with the Trend! Join today by clicking below and know which way to trade by accessing our market directional signal!Disclaimer Notice Past performance is not indicative of future results. Trading stocks, options, forex, CFDs and equites carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts. The information provided by Edvesting.com should not be relied upon as a substitute for extensive independent research which should be performed before making your investment decisions. Edvesting.com are merely providing this information for your general information. The information and opinions presented do not take into account any particular individual's investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision and should tailor the trade size and leverage of their trading to their personal risk appetite. Edvesting.com and/or its owners will not be responsible for any losses incurred on investments made by readers and clients as a result of any information contained on Edvesting.com. Edvesting.com does not render investment, legal, accounting, tax, or other professional advice. If investment, legal, tax, or other expert assistance is required, the services of a competent professional should be sought. |

Follow Us!