Todays Markets

/0 Comments/in Day Trading Signals /by admin|

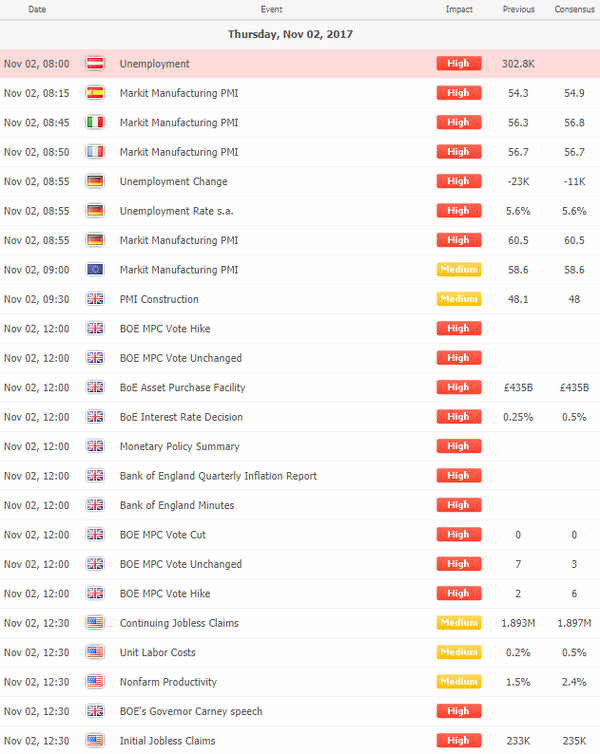

Economic Calendar

|

|

|

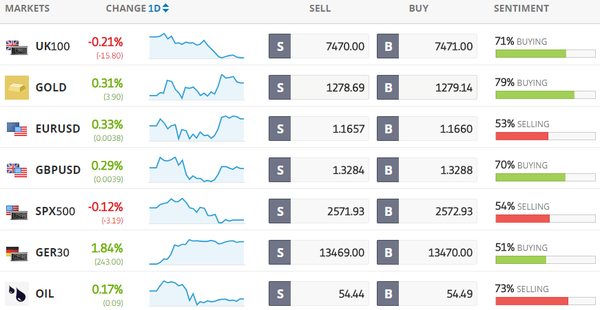

Trading Sentiment

Below is the latest sentiment as compiled by etoro, the world's largest (social) trading network. It provides a view of what individual investors think about the specific instruments and gives a view of the current sentiment.

|

|

|

Latest News Headlines

Bloomberg: Why a Bank of England Rate Rise Could Spook Britain’s Economy

The Bank of England, led by Governor Mark Carney, is expected to raise interest rates for the first time in more than 10 years on Thursday. (more...)

Bloomberg: Dollar Slips With Treasury Yields; Stocks Mixed: Markets Wrap

The dollar declined with Treasury yields amid uncertainty about the prospects of U.S. tax cuts and as investors digested news that President Donald Trump will pick Jerome Powell to lead the Federal Reserve. (more...)

Bloomberg: Tesla's Chinese Suppliers Sink on Slower EV Timeline

Chinese companies that supply Tesla Inc. fell Thursday after Elon Musk indicated his pioneering electric car firm won’t start making vehicles in the world’s largest auto market this decade. (more...)

Bloomberg: Trump Selects Powell for Fed Chairman, Replacing Yellen

President Donald Trump plans to nominate Federal Reserve Governor Jerome Powell to the top job at the U.S. central bank, according to four people familiar with the decision. (more...)

Bloomberg: Credit Suisse Assets Surge to Record in Wealth Management Pivot

While Credit Suisse Group AG wasn’t immune to the trading slump that engulfed rivals, Chief Executive Officer Tidjane Thiam’s pivot to wealth management propelled assets under management to a record. (more...)

Bloomberg: Dollar Rebuilds Gains as FOMC Statement Leaves December in Play

The dollar rebuilt gains after the Federal Open Market Committee said it sees the economy expanding at a “solid” pace despite hurricane-related disruptions; officials left the policy rate unchanged in a widely telegraphed decision. (more...)

Reuters: Asian shares rise on Fed optimism, sterling firms on expected BOE hike

Asian shares touched a 10-year high on Thursday after the U.S. Federal Reserve expressed optimism about the economy, virtually cementing the case for a year-end rate hike as investors awaited the formal nomination of the next head of the central bank. (more...)

Reuters: Fed keeps rates unchanged, remains on road to December hike

The Federal Reserve kept interest rates unchanged on Wednesday and pointed to solid U.S. economic growth and a strengthening labor market while playing down the impact of recent hurricanes, a sign it is on track to lift borrowing costs again in December. (more...)

Reuters: Dollar retreats ahead of U.S. tax bill, pound prepares for rate decision

The dollar pulled back from a 3-1/2-month high versus the yen and also fell back against the euro on Thursday, sagging ahead of a U.S. tax bill that will be unveiled after a one-day delay. (more...)

CNBC: Trump's underlying message on North Korea is the 'right' one, former UN head says

President Donald Trump's rhetoric on North Korean nuclear aggression has been widely criticized for being too inflammatory, but former United Nations Secretary-General Ban Ki-moon said he believes the Republican's underlying message is inherently the right one. (more...)

CNBC: Bitcoin rallies to another record high of $6,900

Bitcoin hit another all-time high Wednesday evening, surpassing $6,900 for the first time. The cryptocurrency has had a bullish streak throughout the week following the CME's announcement that it will introduce bitcoin futures contracts. (more...)

CNBC: Bitcoin is a commodity, not a currency, Allianz's Mohamed El-Erian says

Bitcoin, despite the large amount of interest it has attracted, has not achieved the kind of stability a currency should possess, Allianz Chief Economic Advisor Mohamed El-Erian said, adding that he agrees with the notion that the cryptocurrency is more of a commodity. (more...) |

|

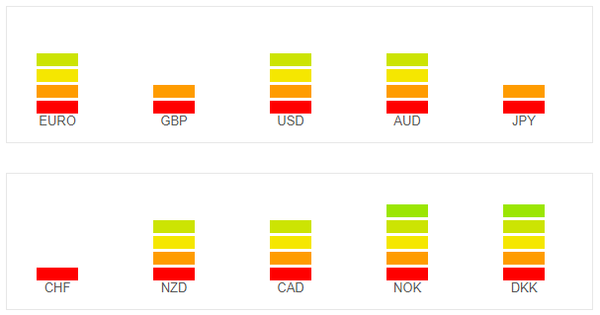

Currency Strength Indicators

|

|

The currency strength meter gives you a quick visual guide to which currencies are currently strong, and which ones are weak. The meter measures the strength of all forex cross pairs and applies calculations on them to determine the overall strength for each individual currency. For example, if EUR is strong and USD is weak, it could mean that the currency pair EURUSD could be going up. If both currencies are strong or weak it is better to avoid since it will probably means there is no clear direction for the specific pair. To get the latest Currency Strength Indicator please click here

Program Trading for 2 November 2017

/0 Comments/in Day Trading Signals /by admin| Sell Programs | No Programs | Buy Programs | |||

|---|---|---|---|---|---|

| Index | Sell Active (SA) |

Sell Threshold (ST) |

Fair Value (Premium) (FV) |

Buy Threshold (BT) |

Buy Active (BA) |

| S&P 500 (TM) |

-4.40 | -3.81 | -3.02 | -1.62 | -0.58 |

| NASDAQ 100 (SM) |

-7.14 | -4.56 | -1.10 | 2.99 | 6.05 |

| Dow Jones Ind. Avg. (SM) |

-66.10 | -63.99 | -61.16 | -44.99 | -32.91 |

S&P Levels of Interest for 2 November 2017

/0 Comments/in Day Trading Signals /by adminR3 2600.00 R2 2591.58 R1 2583.17

DP 2577.08

S1 2568.67 S2 2562.58 S3 2554.17

Follow Us!