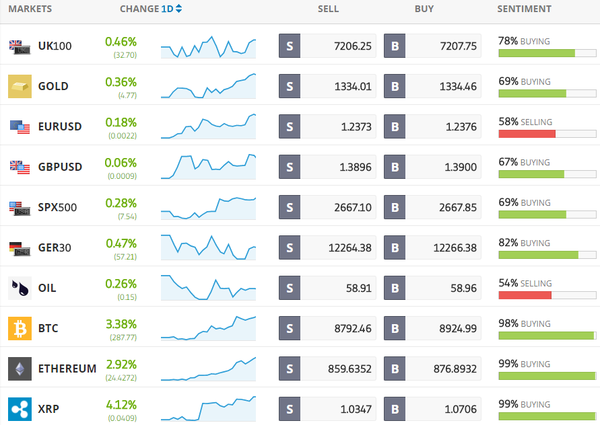

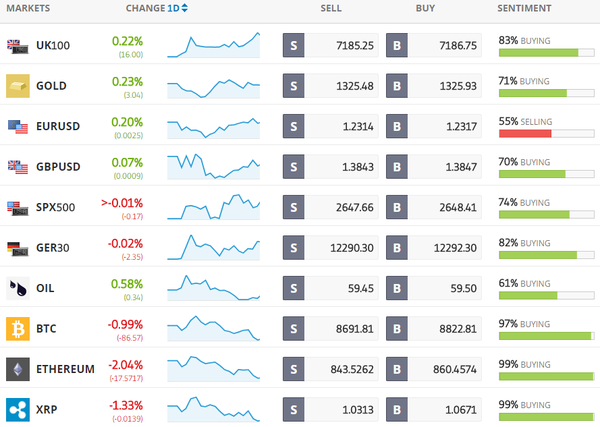

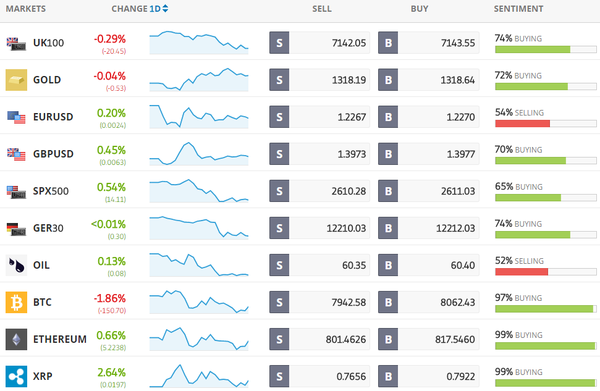

Todays Markets

|

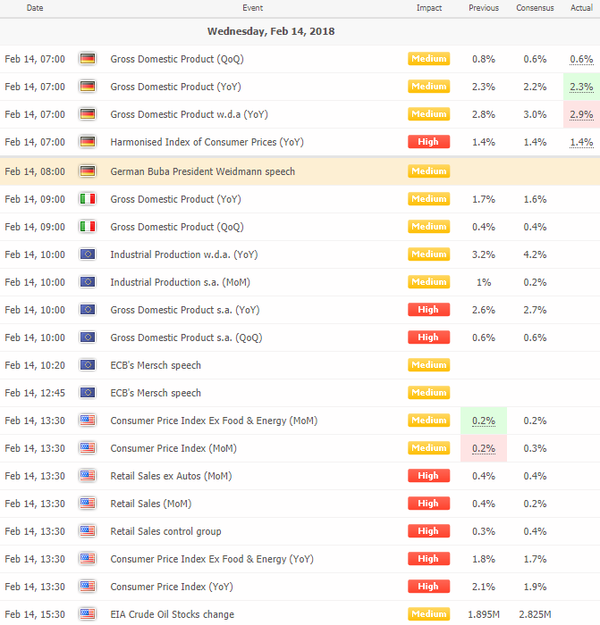

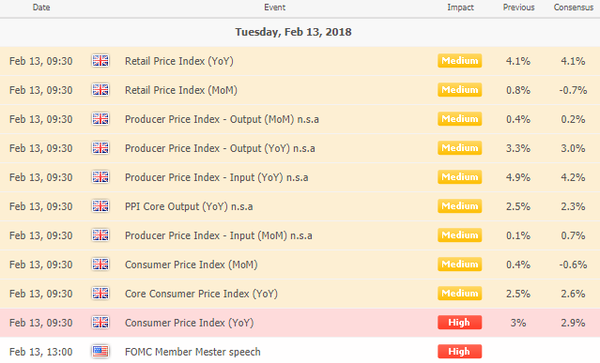

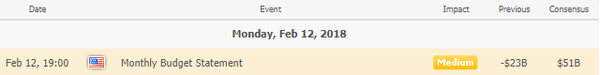

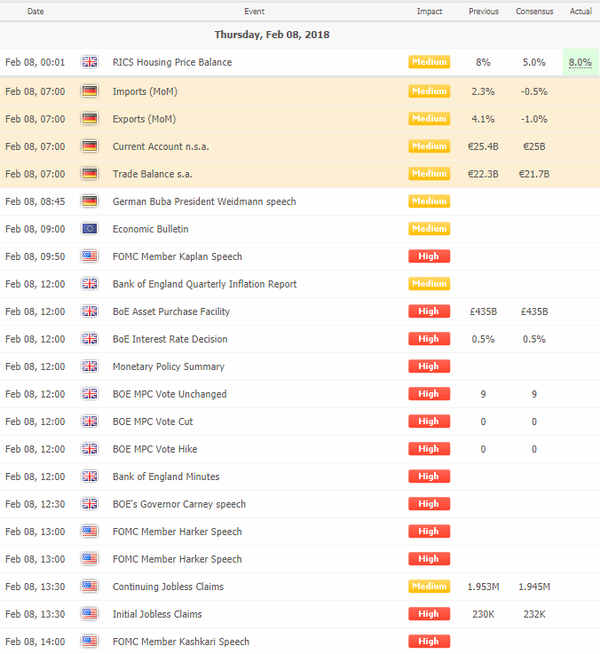

Economic Calendar

|

|

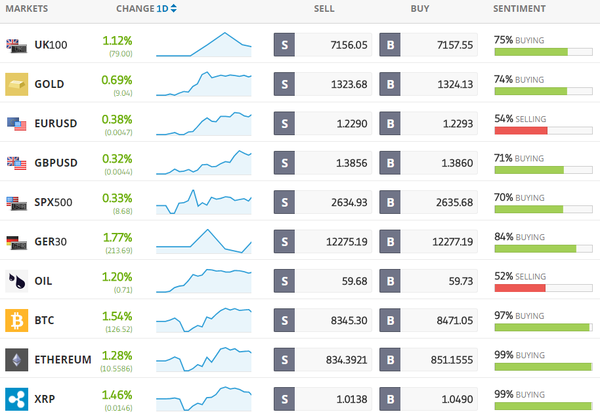

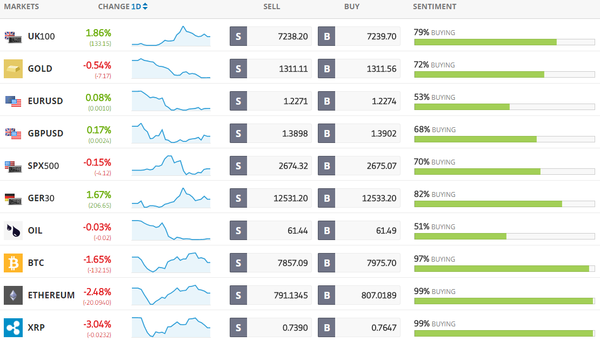

Trading Sentiment

Below is the latest sentiment as compiled by etoro, the world's largest (social) trading network. It provides a view of what individual investors think about the specific instruments and gives a view of the current sentiment.

|

|

Latest News Headlines

Bloomberg: Yen Climbs to 15-Month High, Hitting Japan Stocks: Markets Wrap

The yen climbed to a 15-month high as traders probed Japanese officials’ tolerance for appreciation, hurting the nation’s stocks in what was otherwise a mixed session for Asian equities Wednesday ahead of a key U.S. inflation report. [more...]

Bloomberg: Why Wednesday Could Be a Huge Day for the VIX

The Cboe Volatility Index tends to have bigger swings on days its contracts mature, with intraday moves of 13 percent on average on the past 12 monthly expirations. That compares with a mean daily fluctuation of 10 percent in the year through January. [more...]

Bloomberg: Bond Traders Pay $6 Million to Hedge Surprise Inflation Miss

Bond traders are placing big hedges that the latest read on U.S. price growth will disappoint the growing chorus of inflationistas. [more...]

Bloomberg: Cursed by the Yen: Investor Views on How Currency Haunts Stocks

For many years, Japanese stocks moved in tandem with the yen. When the currency weakened, they tended to rise. Last year, that relationship started to break down. The benchmark Topix index surged 20 percent even as the yen strengthened almost 4 percent against the dollar. [more...]

Bloomberg: FX Volatility Sparks Trading Surge With Signs of More to Come

The past week’s financial-market turbulence is keeping foreign-exchange traders busy, boosting volumes along with volatility. Price swings in the $5.1-trillion a day currency market have jumped at the start of 2018 to the highest since November 2016 on a monthly basis, according to a JPMorgan Chase & Co. gauge. [more...]

Bloomberg: Yen May Have More Surprises in Store for Bulls and Bears Alike

The dollar is on the verge of breaking an all-important technical support level versus the Japanese currency, which may only be the beginning of a sustained period of volatility in the yen as the market comes to terms with its latest strength. [more...]

Reuters: Gasoline, rents seen lifting U.S. monthly CPI; annual rates to slow

U.S. consumer prices likely increased solidly in January, boosted by rising gasoline and rents, but annual inflation growth is expected to have slowed as the large price gains from last year drop out of the calculation. [more...]

Reuters: Asia shares wary of U.S. inflation, dollar breaks down

Asian share markets turned mixed on Wednesday as investor nerves were strained ahead of a U.S. inflation report that could soothe, or inflame, fears of faster rate hikes globally. [more...]

CNBC: Barely anyone is paying the taxes they owe on their bitcoin gains

A tiny fraction of Americans are reporting their cryptocurrency transactions to the IRS, according to a study from Credit Karma Tax. [more...]

CNBC: Credit Suisse CEO on controversial volatility trades: 'It worked well for a long time until it didn't'

Credit Suisse is defending a controversial financial product it issued that played a role in staggering market losses last week. [more...] |

|

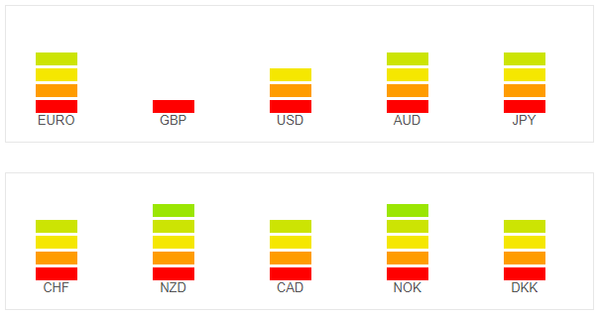

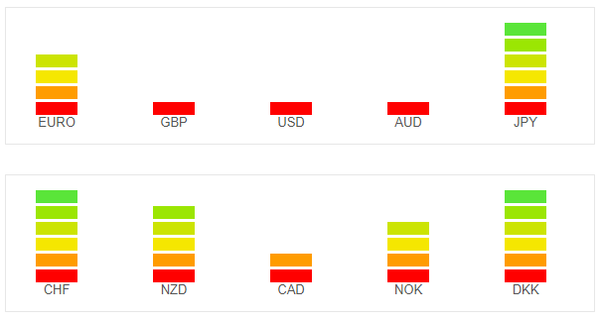

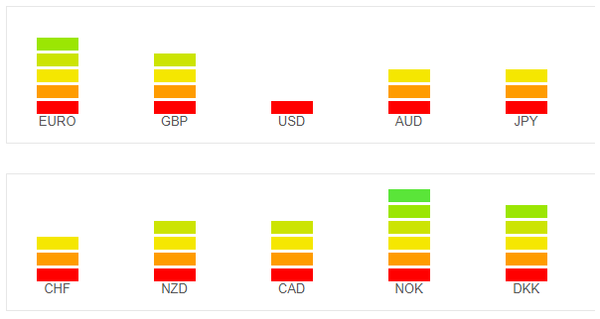

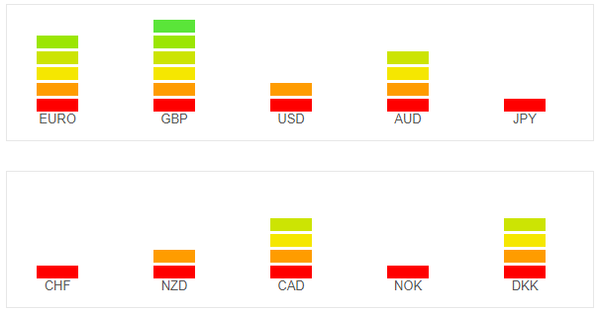

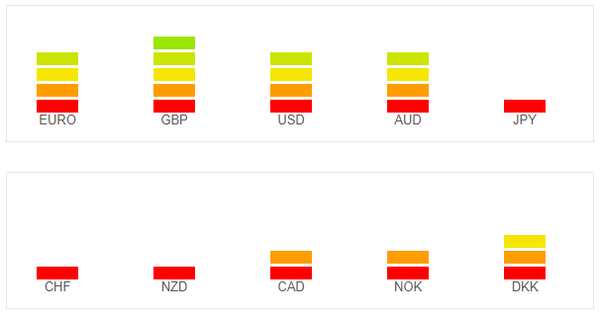

Currency Strength Indicators

|

|

The currency strength meter gives you a quick visual guide to which currencies are currently strong, and which ones are weak. The meter measures the strength of all forex cross pairs and applies calculations on them to determine the overall strength for each individual currency. For example, if EUR is strong and USD is weak, it could mean that the currency pair EURUSD could be going up. If both currencies are strong or weak it is better to avoid since it will probably means there is no clear direction for the specific pair. To get the latest Currency Strength Indicator please click here

Follow Us!