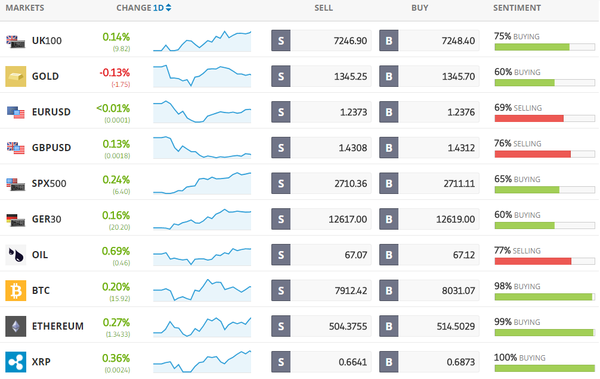

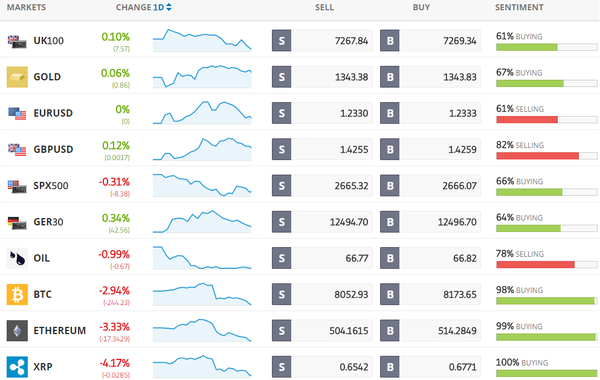

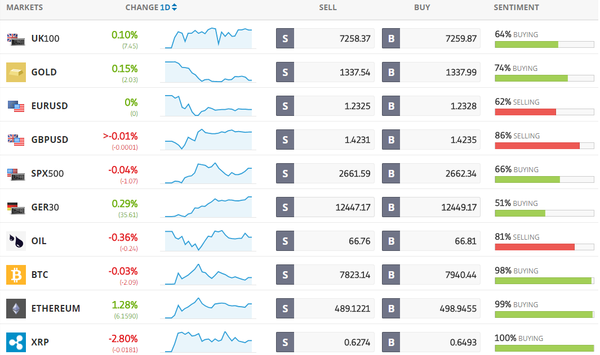

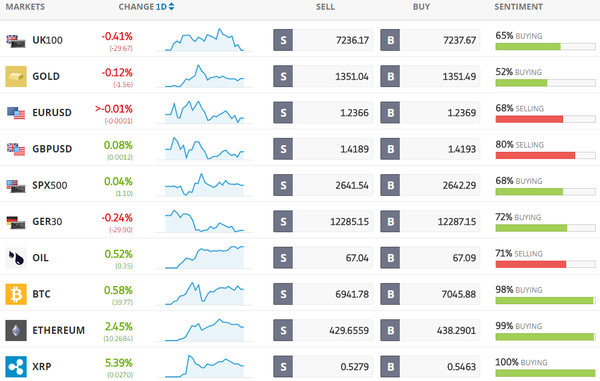

Todays Markets

|

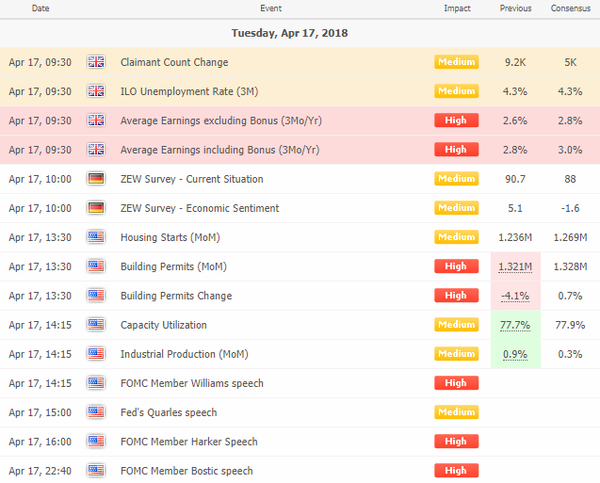

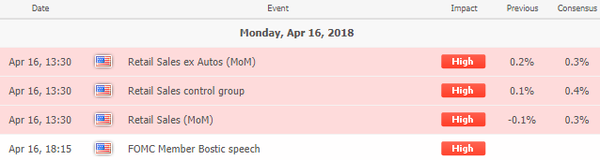

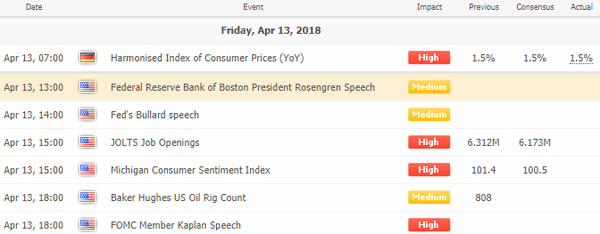

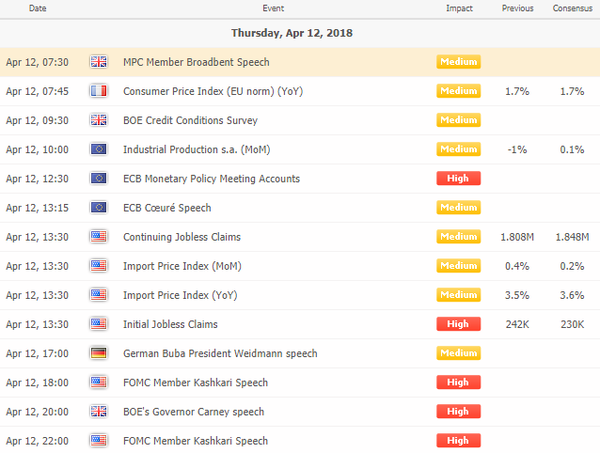

Economic Calendar

|

|

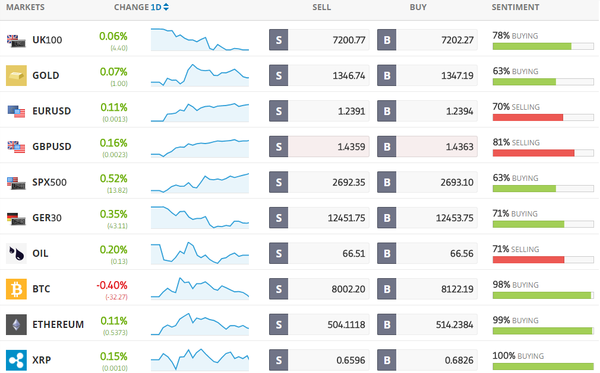

Trading Sentiment

Below is the latest sentiment as compiled by etoro, the world's largest (social) trading network. It provides a view of what individual investors think about the specific instruments and gives a view of the current sentiment.

|

|

Latest News Headlines

Bloomberg: Stocks in Asia Rise on Earnings Hopes; Yen Slides: Markets Wrap

Equities in Asia advanced, helped by an encouraging start to U.S. earnings season, while Chinese bonds rallied after the nation’s central bank moved to support liquidity. The yen dipped amid a summit between U.S. President Donald Trump and Japanese Prime Minister Shinzo Abe. [more...]

Bloomberg: Jet Engine That Exploded Had Signs of Metal Weakness, U.S. Says

Southwest Airlines Co. is stepping up inspections on its jet fleet after investigators said they discovered evidence of metal fatigue on an engine that exploded Tuesday, sending shrapnel into the plane and killing a passenger seated near a window. [more...]

Bloomberg: Return of Volatility Means It’s Time to Buy Emerging Markets: Titus

The renaissance in volatility over the last few months has created an opportunity to buy emerging-market stocks amid prospects for further growth, according to Titus Wealth Management. [more...]

Bloomberg: Old Wall Street Strategies Turn Hugely Profitable in China

Stock pickers may have to reconsider the way they think about China. Dismissed by many as a casino after its wild boom and bust in 2015, the country’s $7.6 trillion equity market has quietly turned into a place where fundamentals matter. [more...]

Bloomberg: OPEC-Russia Talks Set to Keep Oil Cuts Even as Glut Vanishes

OPEC and Russia will meet in Saudi Arabia this week after all but banishing a global oil glut. While looming political crises threaten to tighten supplies further, the group seems determined to keep its cuts in place. [more...]

Bloomberg: Cryptocurrency Exchanges Get ‘Fact-Finding’ Letter from New York

New York Attorney General Eric Schneiderman asked 13 cryptocurrency exchanges for detailed information about their operations as part of a "fact-finding inquiry." [more...]

Bloomberg: The Swiss Franc Is Almost Back to Its Famous Limit

Having touched a three-year low of 1.19 per euro on Tuesday, the franc is now less than a centime away of the 1.20 mark at which the Swiss National Bank had its minimum exchange rate until early 2015 -- enforcing it with what the central bank termed “unlimited” foreign exchange interventions. [more...]

Reuters: Asian shares edge higher in step with Wall Street, China lags

Asian shares crept ahead on Wednesday after Wall Street took heart from upbeat corporate earnings, though nagging concerns about trade barriers and the global growth outlook kept currencies and bonds subdued. [more...]

Reuters: Oil prices rise on lower U.S. crude inventories, global supply risks

Oil prices rose on Wednesday, lifted by a reported fall in U.S. crude inventories and by the ongoing risk of supply disruptions. [more...]

CNBC: Israel ‘will be punished’ for its strike on Iranian drone base, Tehran says

Iran has issued a threat against Israel following last weekend's attack on an Iranian drone base in Syria. The strike, which killed seven Iranian military advisors from the country's elite Quds Force in the Syrian city of Homs, has been neither confirmed nor denied by Israel's government. [more...] |

|

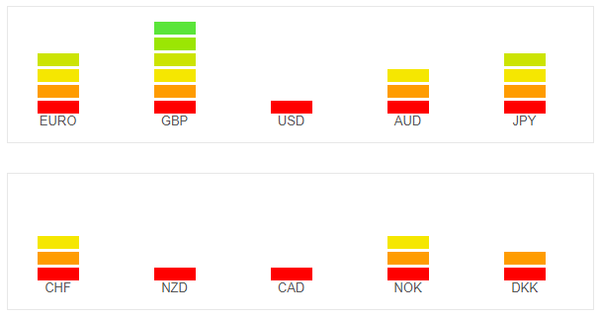

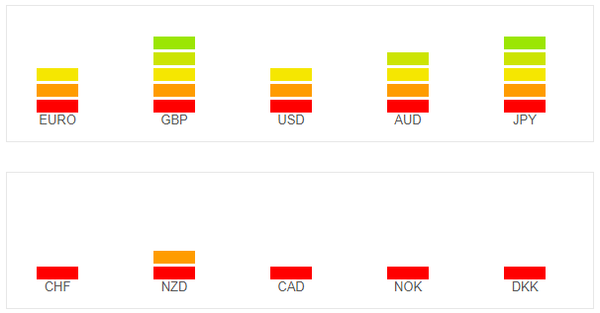

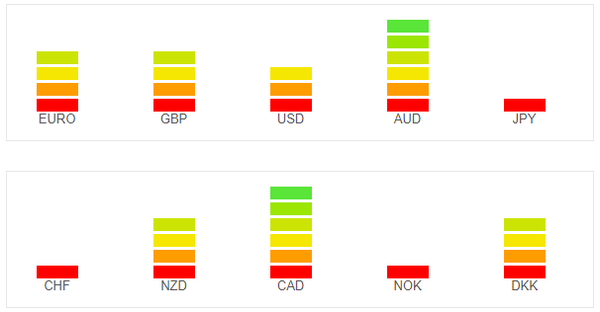

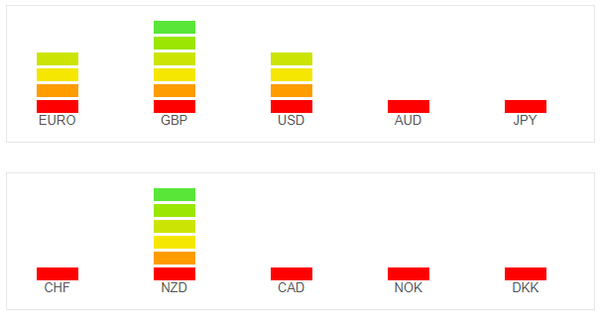

Currency Strength Indicators

|

The currency strength meter gives you a quick visual guide to which currencies are currently strong, and which ones are weak. The meter measures the strength of all forex cross pairs and applies calculations on them to determine the overall strength for each individual currency. For example, if EUR is strong and USD is weak, it could mean that the currency pair EURUSD could be going up. If both currencies are strong or weak it is better to avoid since it will probably means there is no clear direction for the specific pair. To get the latest Currency Strength Indicator please click here

Follow Us!