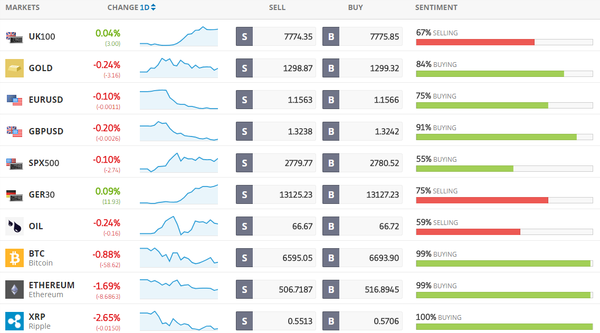

Todays Markets

|

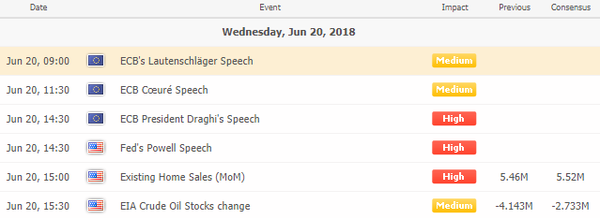

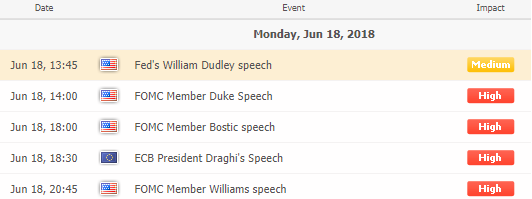

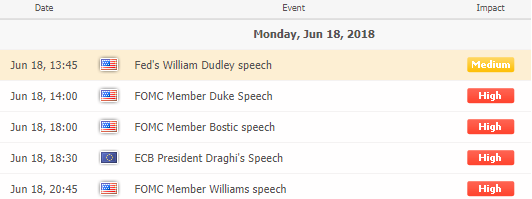

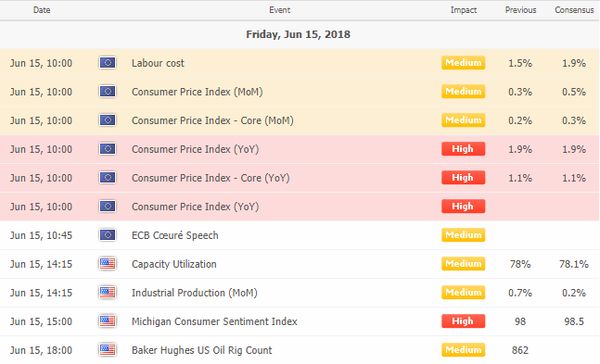

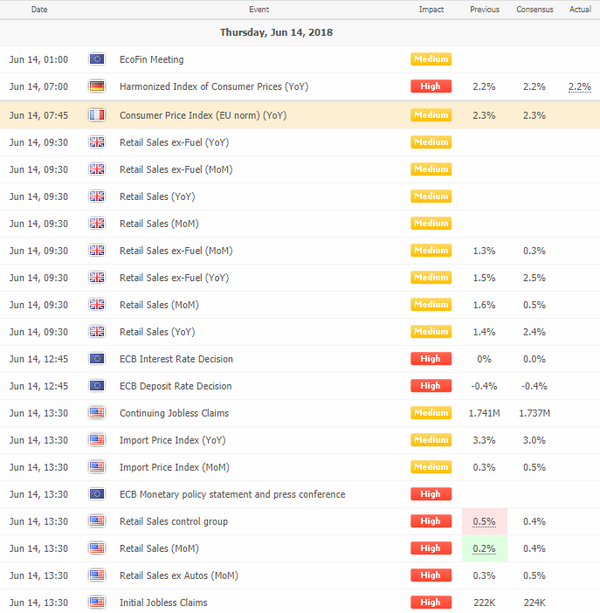

Economic Calendar

|

|

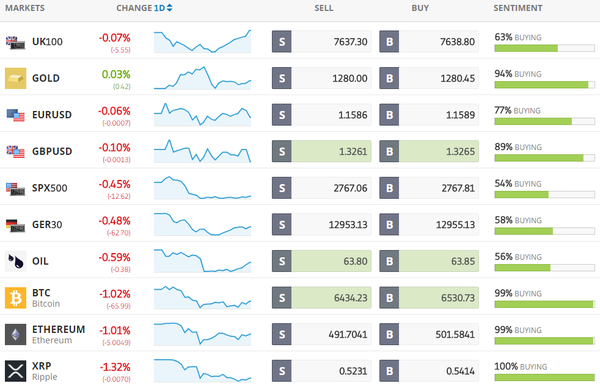

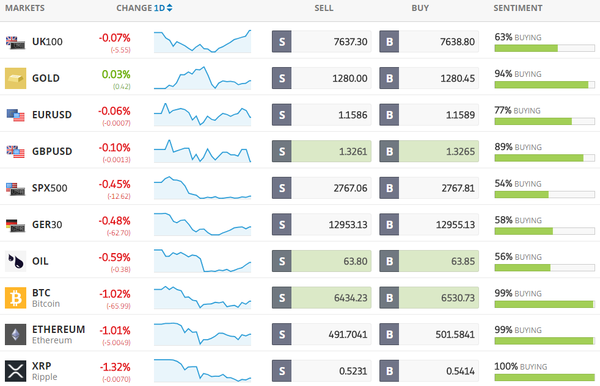

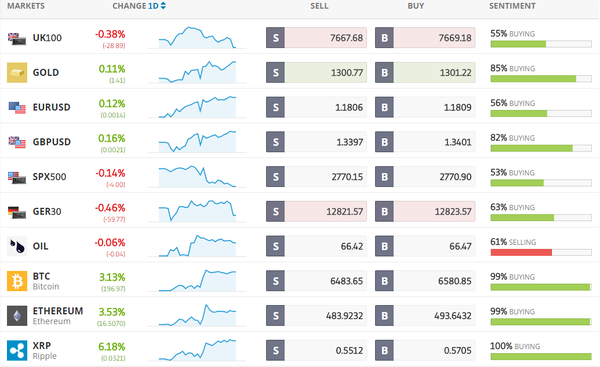

Trading Sentiment

Below is the latest sentiment as compiled by etoro, the world's largest (social) trading network. It provides a view of what individual investors think about the specific instruments and gives a view of the current sentiment.

|

|

Latest News Headlines

Bloomberg: Stocks Recover as Trade Angst Eases; Dollar Steady: Markets Wrap

Stocks in Asia rebounded in a choppy session as investors awaited the next development in U.S.-China trade tensions after a ratcheting up of rhetoric sparked a global sell-off on Tuesday. Treasury yields edged higher and the dollar stabilized. [more...]

Bloomberg: Iran Rejects Compromise as OPEC Heads for Battle in Vienna

Iran put itself on a collision course with Saudi Arabia at this week’s OPEC meeting, rejecting a potential compromise that would see a small oil-production increase to appease energy consumers. [more...]

Blooberg: Australian Dollar May Drop to 70 Cents This Year: BlackRock

Australia’s dollar is at risk of sliding to 70 U.S. cents this year as China’s economy slows and the Federal Reserve keeps raising U.S. interest rates, according to BlackRock Inc. [more...]

Bloomberg: Quebec Hikes Power Prices for Crypto Miners

Quebec will make electricity prohibitively expensive for cryptocurrency miners until it figures out how to deal with a surge in demand from the energy-hungry industry. [more...]

Bloomberg: India Seeks `Responsible' OPEC Decision as Vienna Tensions Mount

India, the world’s third-largest oil consumer, expects a “responsible” approach from its suppliers as speculation mounts over whether OPEC and its allies will reach a deal to boost output at a meeting in Vienna this week. [more...]

Bloomberg: China Rout Has 1,023 Stocks Plunging 10% in One Day

In a stock market where investors are used to being disappointed, Tuesday’s plunge still shocked. China’s benchmark equity gauge sank almost 5 percent at one point and by the close, the escalating tensions with the U.S. had sent 1,023 stocks down by the daily 10 percent limit -- or more than one in four. [more...]

Bloomberg: Wall Street Forced to Recalibrate as Trade War Gets ‘More Real’

For months, investors have dismissed Donald Trump’s fiery rhetoric on trade with China as negotiating bluster. That got a lot harder after the U.S. president threatened more tariffs and China promised in-kind retaliation. [more...]

Reuters: Asian stocks pick up steam as hopes of policy support lift China

Asian stock markets picked up steam in afternoon trade on Wednesday after a wobbly morning session, highlighting the lingering anxiety and uncertainty surrounding a heated trade dispute between China and the United States. [more...]

Reuters: U.S. shale producers warn Chinese tariffs would hit energy exports

China’s proposed tariffs on U.S. petroleum imports, part of a mounting trade war between the two countries, would crimp sales to the shale industry’s largest customer, adding new pressure on U.S. crude prices, energy executives and analysts said in interviews this week. [more...]

CNBC: South Korean cryptocurrency exchange Bithumb says it was hacked and $30 million in coins was stolen

South Korea-based cryptocurrency exchange Bithumb said Wednesday it was temporarily suspending deposit and withdrawal services after about $30 million worth of cryptocurrency was stolen. [more...]

CNBC: White House says China's 'economic aggression' is a global threat

The Trump administration ratcheted up its criticism of China in a report released by the White House on Tuesday detailing its claims of "economic aggression" by the Asian giant. [more...] |

|

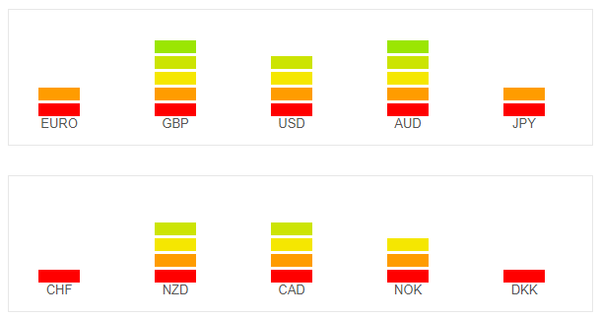

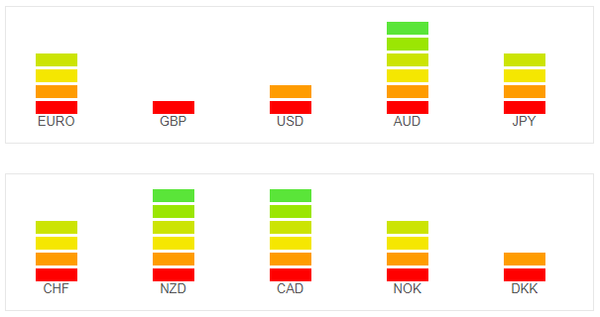

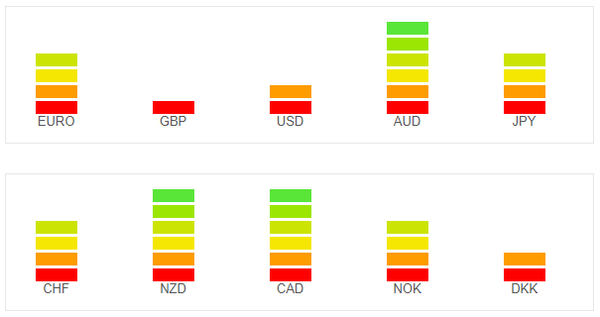

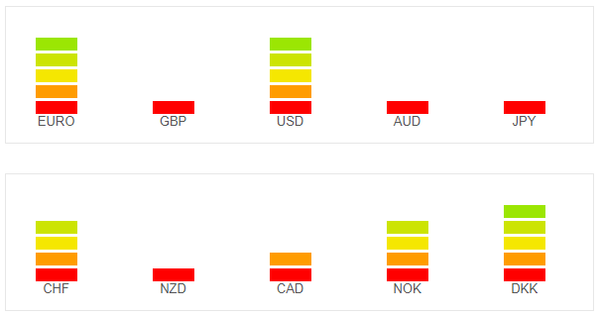

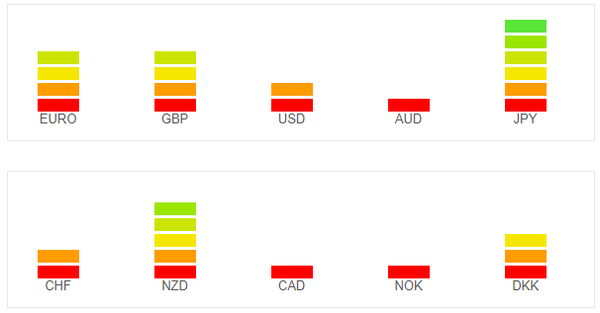

Currency Strength Indicators

|

|

The currency strength meter gives you a quick visual guide to which currencies are currently strong, and which ones are weak. The meter measures the strength of all forex cross pairs and applies calculations on them to determine the overall strength for each individual currency. For example, if EUR is strong and USD is weak, it could mean that the currency pair EURUSD could be going up. If both currencies are strong or weak it is better to avoid since it will probably means there is no clear direction for the specific pair. To get the latest Currency Strength Indicator please click here

Follow Us!