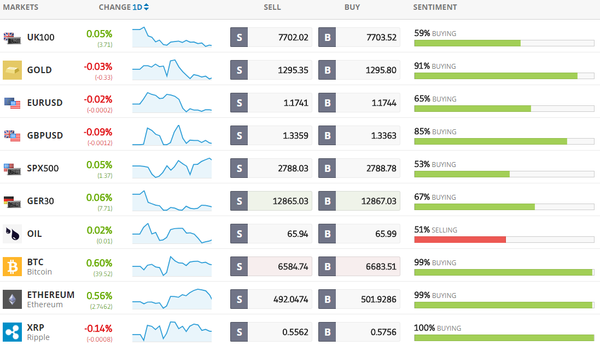

Todays Markets

|

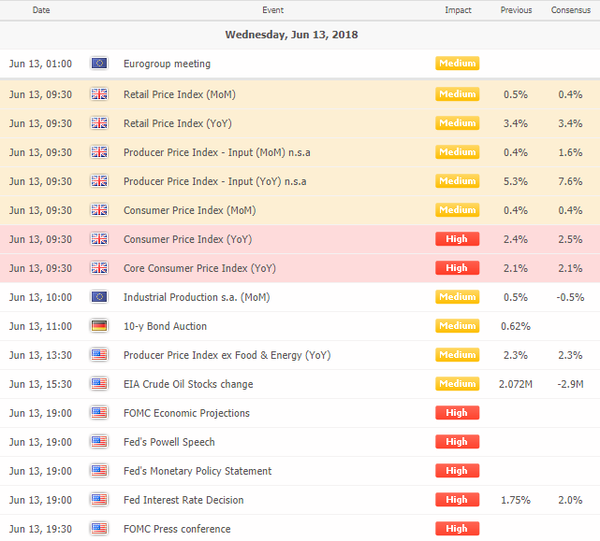

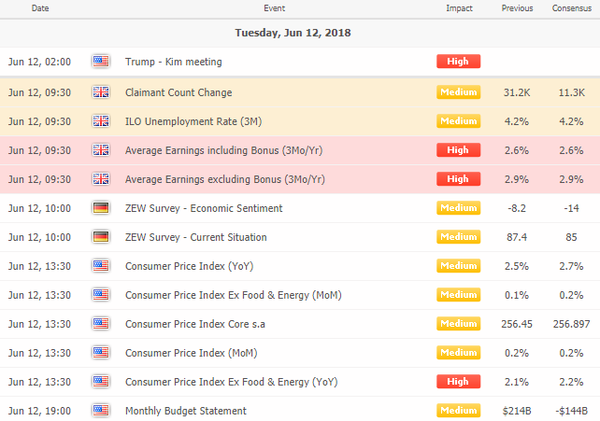

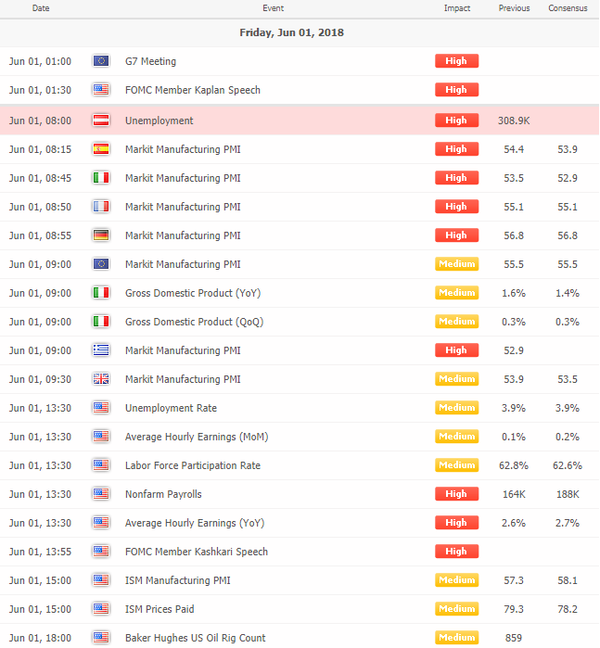

Economic Calendar

|

|

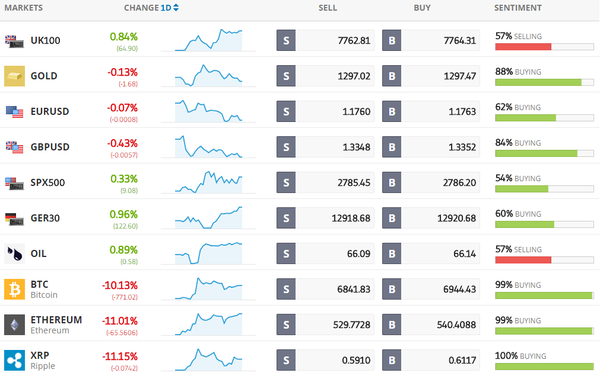

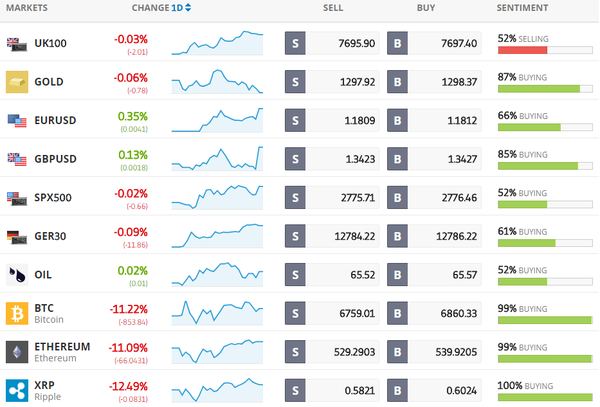

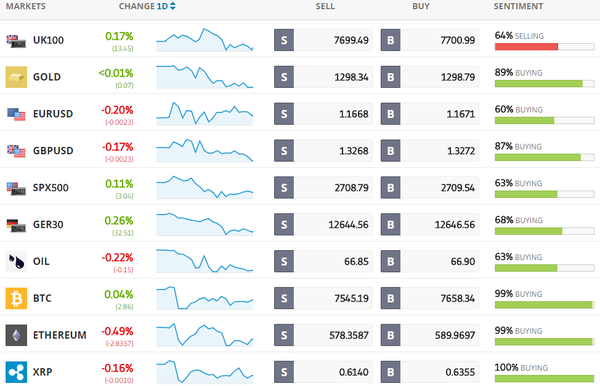

Trading Sentiment

Below is the latest sentiment as compiled by etoro, the world's largest (social) trading network. It provides a view of what individual investors think about the specific instruments and gives a view of the current sentiment.

|

|

Latest News Headlines

Bloomberg: Asia Stocks Mixed, Dollar Flat Before Fed Meeting: Markets Wrap

Asian stocks were mixed following a lackluster session in the U.S. as investors await the major central bank meetings this week, after shrugging at Tuesday’s North Korea summit. [more...]

Bloomberg: Bitcoin’s Collapse Accelerates, Falls to Lowest Since February

Bitcoin tumbled to its lowest level since February as the meltdown in the world’s largest digital currency accelerated, renewing concern about the long-term viability of the much hyped alternative to traditional currencies. [more...]

Bloomberg: U.S. Inflation Accelerates to Six-Year High, Eroding Wages

U.S. inflation accelerated in May to the fastest pace in more than six years, reinforcing the Federal Reserve’s outlook for gradual interest-rate hikes while eroding wage gains that remain relatively tepid despite an 18-year low in unemployment. [more...]

Bloomberg: Tesla Is Cutting About 9% of Workers on Musk's Profitability Push

Elon Musk has finally been forced to rethink his vaulting ambitions for Tesla Inc. The news Tuesday that Musk will dismiss more than 3,000 employees, or about 9 percent of the company’s workforce, underscored what many on Wall Street have been saying for months: Tesla has reached a pivotal moment. [more...]

Bloomberg: Fed Dots in Focus as Market Awaits Rate Hike: Decision-Day Guide

Federal Reserve Chairman Jerome Powell has repeatedly played down the central bank’s “dot plot” as a guide to future interest rates, but Wall Street just won’t take the hint. [more...]

Reuters: Asian stocks step back as investors brace for Fed, eye trade row

Asian shares fell on Wednesday as investors braced for a Federal Reserve policy decision later in the day and any clues it might give on future rate hikes that could alter the course of global economic growth and corporate earnings. [more...]

Reuters: WTO chief warns of global downturn if trade dispute escalates

If the trade conflict between the United States and other countries intensifies, it could negatively impact the global economy and there are indications this is already happening, the head of the World Trade Organization warned in newspaper. [more...]

CNBC: Kim Jong Un appeared to score an 'A+' victory — Trump's work is 'incomplete'

North Korea's Kim Jong Un and President Donald Trump both celebrated Tuesday's historic summit as a victory. But many experts see Kim, having won a substantial concession from the world's largest economy while simultaneously gaining greater claims to legitimacy, as the real winner. [more...]

CNBC: 'We have a deal,' say Greece and Macedonia over name dispute

Greece and Macedonia have reached an historic accord to resolve a dispute over the former Yugoslav republic's name that has troubled relations between the two neighbors for decades. [more...] |

|

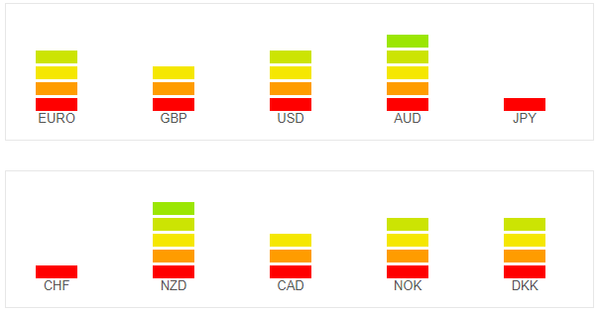

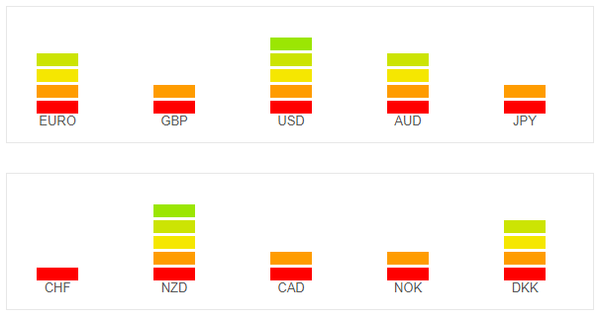

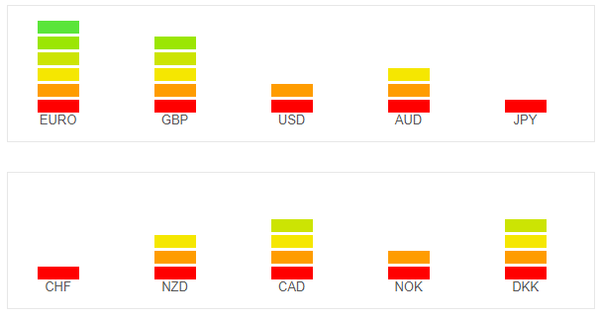

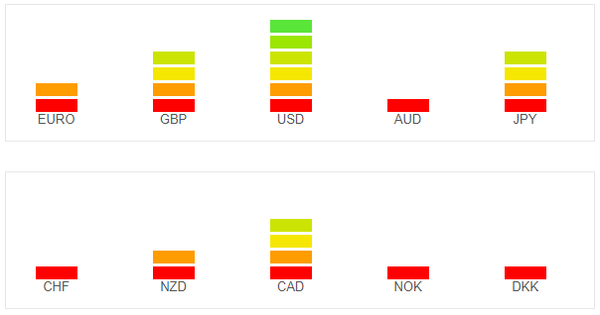

Currency Strength Indicators

|

|

The currency strength meter gives you a quick visual guide to which currencies are currently strong, and which ones are weak. The meter measures the strength of all forex cross pairs and applies calculations on them to determine the overall strength for each individual currency. For example, if EUR is strong and USD is weak, it could mean that the currency pair EURUSD could be going up. If both currencies are strong or weak it is better to avoid since it will probably means there is no clear direction for the specific pair. To get the latest Currency Strength Indicator please click here

Follow Us!