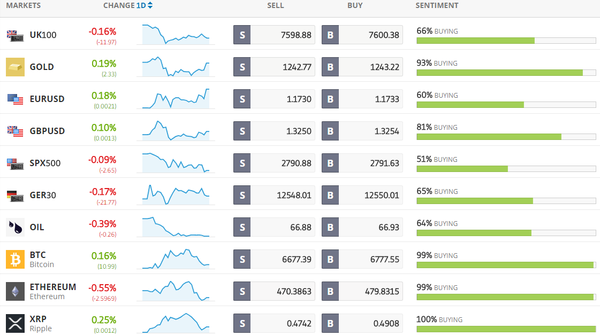

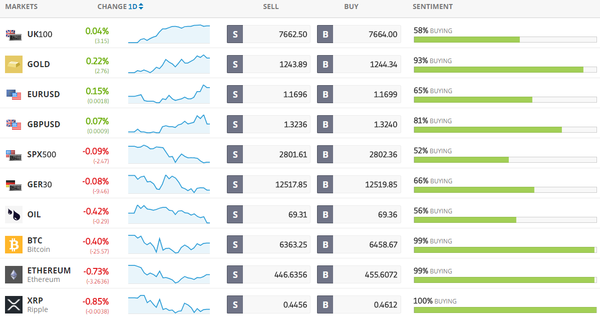

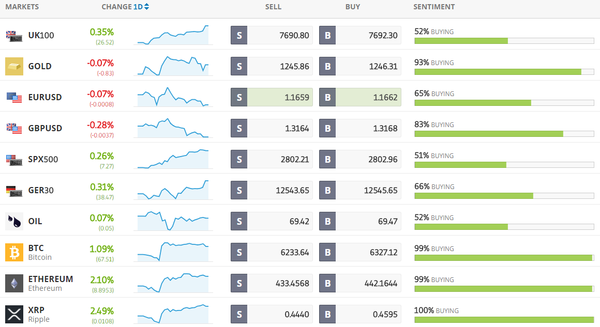

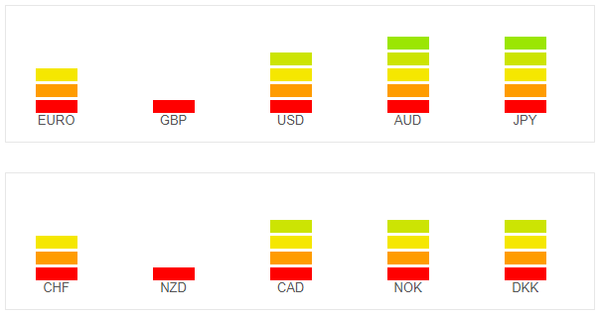

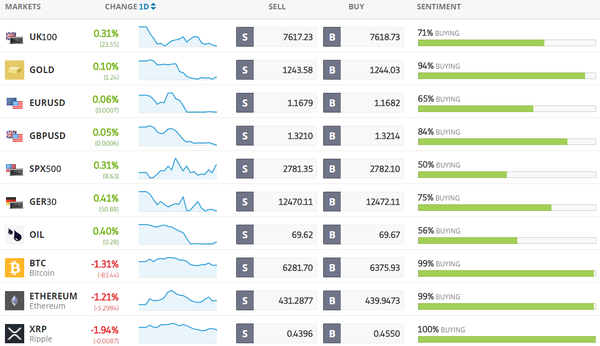

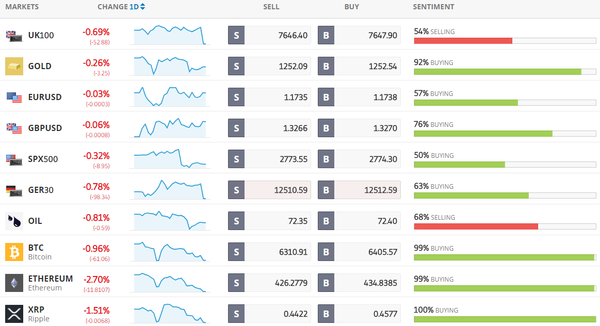

Todays Markets

|

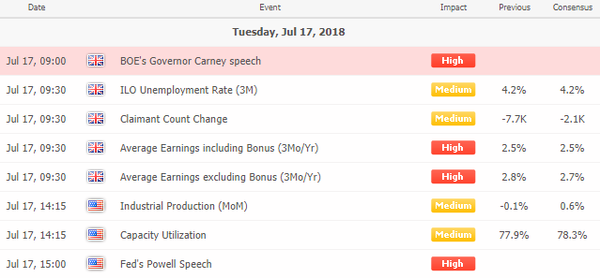

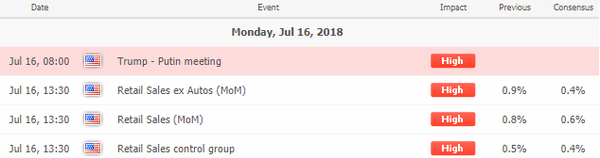

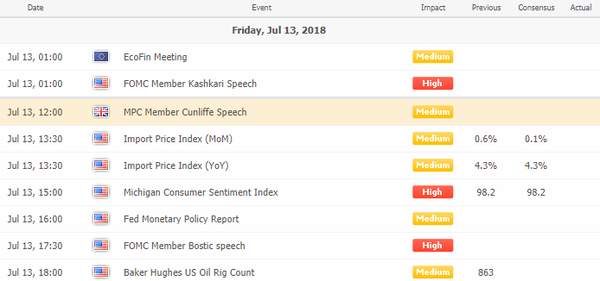

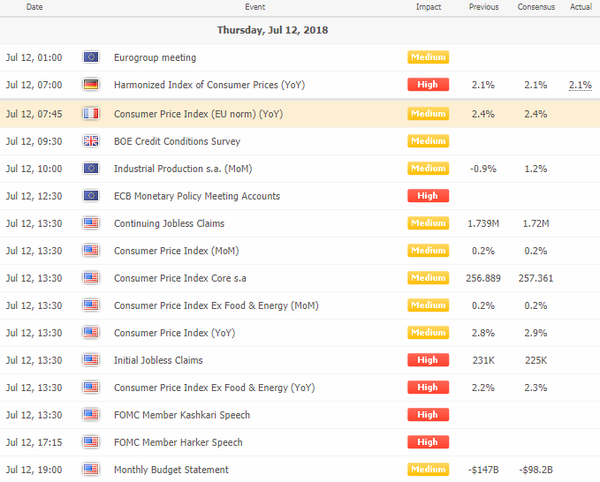

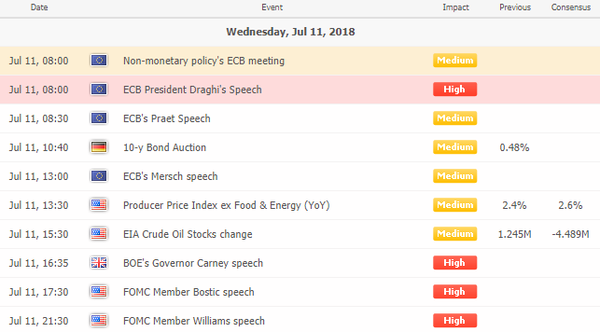

Economic Calendar

|

|

|

|

Latest News Headlines

Bloomberg: Jeff Bezos Becomes the Richest Man in Modern History, Topping $150 Billion

Jeff Bezos is the richest person in modern history. The Amazon.com Inc. founder’s net worth cracked $150 billion in New York on Monday, according to the Bloomberg Billionaires Index. That’s about $55 billion more than Microsoft Corp. co-founder Bill Gates, the world’s second-richest person. [more...] Bloomberg: Stocks Mixed as Trade Concerns Persist; Yen Falls: Markets Wrap

Equities in Asia were mixed Tuesday as investors assess whether corporate earnings can deliver on high expectations against a backdrop of trade tensions. Treasuries and the dollar were steady ahead of testimony from Federal Reserve Chairman Jerome Powell. [more...]

Bloomberg: Powell to Cross Political Minefield as Trade War Clouds Outlook

Two of the biggest risks to Jerome Powell’s monetary policy -- trade tensions and loose fiscal policy -- are also the stickiest political traps he’ll try to avoid when he appears before lawmakers this week. [more...]

Bloomberg: Brexit U.K. Suffers Car-Sales Drop as Europe Flourishes

The U.K. is moving away from mainland Europe, and not just politically. Sales of new vehicles in Britain, the region’s second-biggest market, dropped 6.3 percent in the first half of this year, extending last year’s slide. The fall in demand runs counter to an uptick in sales for the continent. [more...]

Bloomberg: Robots Will Bolster U.K. Growth and Create New Jobs, PwC Says

Robots could destroy about 7 million existing U.K. jobs but create at least that many more over the next two decades, according to analysis by PricewaterhouseCoopers. [more...]

Bloomberg: Goldman Sachs Says U.S. Political Policy Stoking Oil Volatility

U.S. political decisions are helping make volatility the new normal in the global oil market and muddying the outlook for prices, according to Goldman Sachs Group Inc. [more...]

Blooomberg: Sovereign Wealth Fund Warning Light Is Flashing

Pension funds and insurers are being increasingly tempted to shift money out of publicly traded securities in pursuit of more lucrative private investments. But they should pay more heed to what the some of the largest pools of money are doing. [more...]

Bloomberg: Warnings of Market Complacency Are Growing Louder

A growing chorus of observers is saying that financial markets are too sanguine about the threat that a U.S.-instigated trade war poses to global output and asset values. [more...]

Bloomberg: UBS Abandons Call for Yuan Gain in '18; Trims China GDP View

UBS Group AG abandoned its forecast for the yuan to appreciate this year, anticipating that the trade war will continue to put pressure on the currency, hurt China’s economic growth and spur the country’s policy makers to unleash more liquidity. [more...]

Reuters: Asia stocks sag on oil's slide, dollar dips before Fed testimony

Asian stocks were mostly lower on Tuesday, with a sharp decline in crude oil prices weighing on energy shares, while the dollar dipped ahead of Federal Reserve Chairman Jerome Powell’s first U.S. congressional testimony. [more...]

Reuters: Strong U.S. retail sales lift second-quarter GDP estimates

U.S. retail sales rose solidly in June as households boosted purchases of automobiles and a range of other goods, cementing expectations for robust economic growth in the second quarter. [more...]

CNBC: Investment in energy fell again in 2017, raising fresh concerns about security and climate change

The amount of money flowing into the energy sector fell for a third straight year, raising concerns about the world's ability to provide enough power and tackle climate change, the International Energy Agency reported on Tuesday. [more...]

CNBC: Tech stocks set to sink on Tuesday after rough evening for ‘FANG’

Technology stocks are headed for a rough session on Tuesday after shares of Netflix, one of the momentum leaders of this bull market, tanked after earnings. Amazon shares fell as well. [more...] |

|

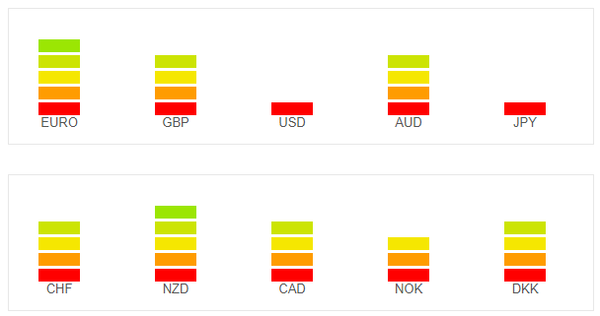

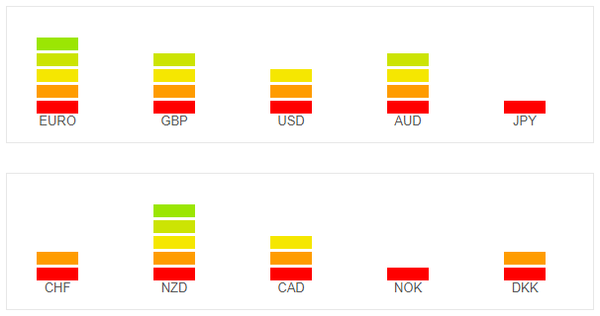

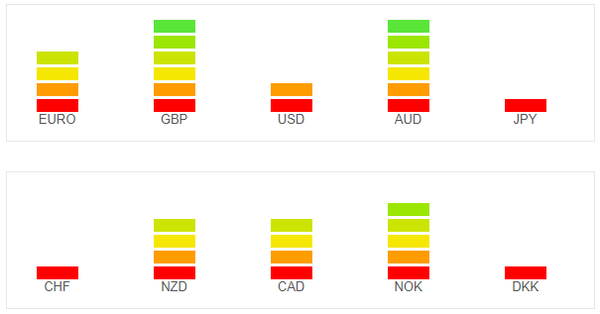

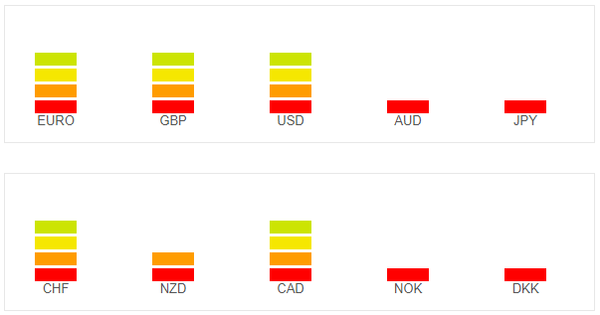

Currency Strength Indicators

|

|

Follow Us!