Todays Markets

|

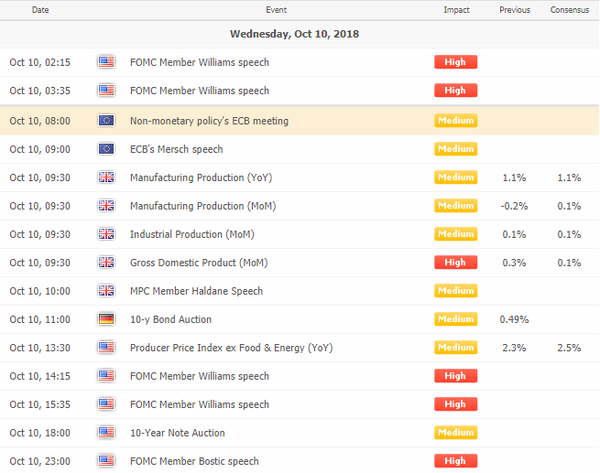

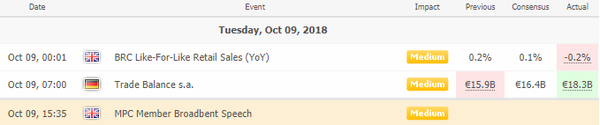

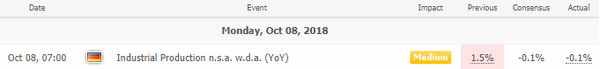

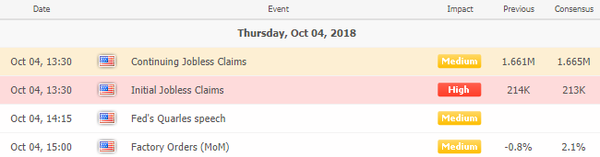

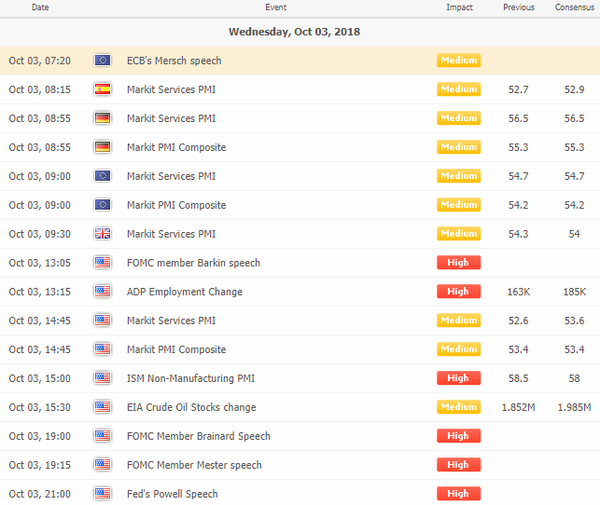

Economic Calendar

|

|

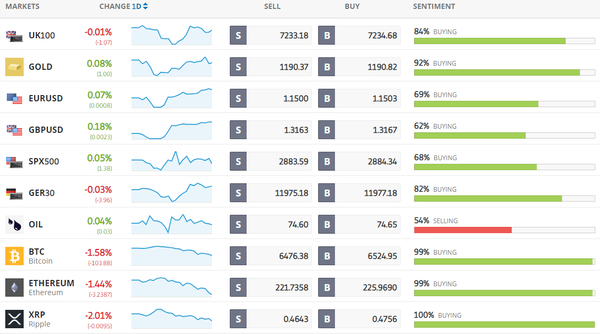

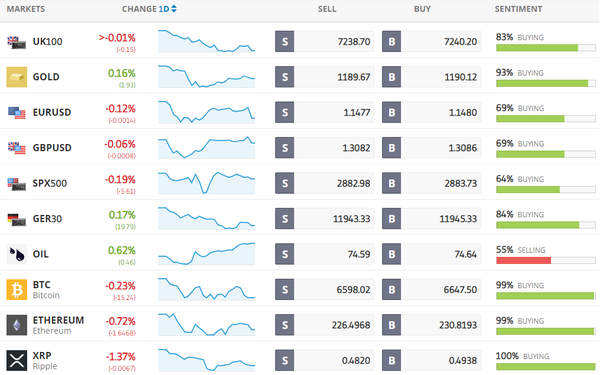

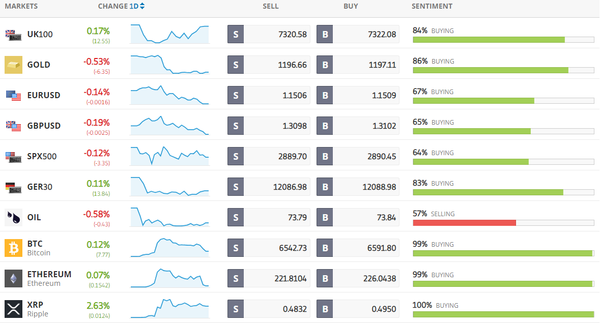

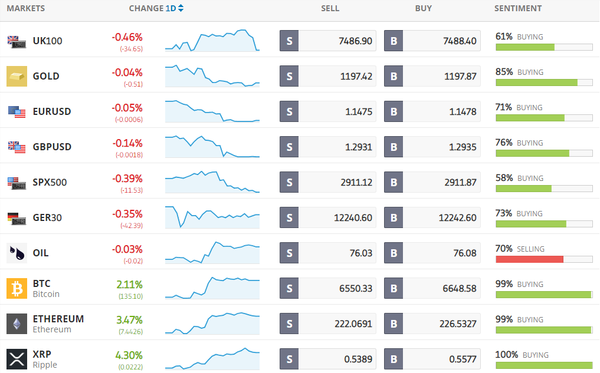

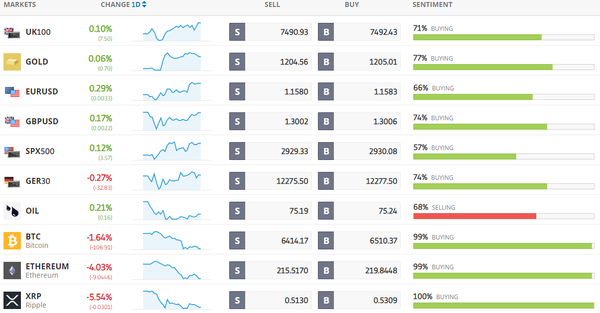

Trading Sentiment

Below is the latest sentiment as compiled by etoro, the world's largest (social) trading network. It provides a view of what individual investors think about the specific instruments and gives a view of the current sentiment.

|

|

Latest News Headlines

Bloomberg: Asian Stocks Mixed as Treasury Yields Stabilize: Markets Wrap

Asian stocks traded mixed Wednesday as yields on Treasuries retreated from a seven-year peak. The dollar edged lower against major peers. Shares in Japan rose after four days of losses while those in China reversed gains. [more...]

Bloomberg: New Evidence of Hacked Supermicro Hardware Found in U.S. Telecom

A major U.S. telecommunications company discovered manipulated hardware from Super Micro Computer Inc. in its network and removed it in August, fresh evidence of tampering in China of critical technology components bound for the U.S., according to a security expert working for the telecom company. [more...]

Bloomberg: Giant Funds Bet on `America First' to Win Again in 2019 Markets

American stocks may be looking increasingly expensive compared with the rest of the world, but some major fund managers see their outperformance stretching into next year, fueled by earnings growth and a strong economy. [more...]

Bloomberg: Investors Underestimate Risk of a Financial Shock, IMF Warns

Investors may be ignoring the risk that financial conditions could tighten sharply and send tremors through the global economy, the International Monetary Fund warned. [more...]

Bloomberg: Big Oil Could Reap Windfall on Fossil Fuel Limits, Goldman Says

Cracking down on fossil fuels could actually boost profits for the world’s biggest oil companies, though the industry must shift toward cleaner fuels or be left behind by investors, according to Goldman Sachs Group Inc. [more...]

Bloomberg: JPMorgan Asset Says It's Time to Buy Bonds as Growth Risks Mount

JPMorgan Asset Management says its time for investors to boost allocation to bonds to cushion their portfolio amid mounting risks to global growth. [more...]

Bloomberg: Short Seller Who Foresaw Valeant Crash Now Bets on Tesla Falling

Short seller Fahmi Quadir, who bet against the drugmaker formerly known as Valeant Pharmaceuticals around its peak in 2015, is now betting on a dramatic drop in Tesla Inc. shares. [more...]

Bloomberg: Singapore Will Help Crypto Firms Set Up Local Bank Accounts

Singapore’s financial regulator is willing to lend a hand to cryptocurrency firms having problems setting up local bank accounts, but doesn’t plan to loosen its rules to lure more crypto startups to the country. [more...]

Bloomberg: Currency ‘Cartel’ Traders on Trial for Chats That Cost Billions

The three British currency traders who were part of an exclusive online chat group referred to by members as “the cartel” go on trial this week for alleged market manipulation that’s already cost global banks $14 billion in penalties. [more...]

Reuters: Asian shares subdued as global bond sell-off eases; sterling rises

Asian shares barely moved on Wednesday after world stocks hit eight-week lows the previous day on worries about global economic growth, although the British pound stayed firm on hopes for a Brexit deal. [more...]

Reuters: Oil dips as IMF lowers global growth outlook; eyes on U.S. hurricane

Oil prices edged lower on Wednesday after the IMF lowered its global growth forecasts but prices were supported as Hurricane Michael churned toward Florida, causing the shutdown of nearly 40 percent of U.S. Gulf of Mexico crude output. [more...]

CNBC: Chinese tech giant Huawei unveils A.I. chips, taking aim at giants like Qualcomm and Nvidia

Huawei unveiled two new artificial intelligence chips aimed at data centers and smart devices, pitting it against major silicon players including Qualcomm and Nvidia, as the Chinese giant laid out a strategy it hopes will drive growth in the next few years. [more...]

CNBC: Hurricane Michael upgraded to 'extremely dangerous' Category 4 storm

Michael has intensified into an extremely dangerous Category 4 hurricane on the five-step Saffir-Simpson scale and is expected to strengthen further before making landfall in the Florida Panhandle or the Florida Big Bend area, the U.S. National Hurricane Center (NHC) said on Wednesday. [more...] |

Follow Us!