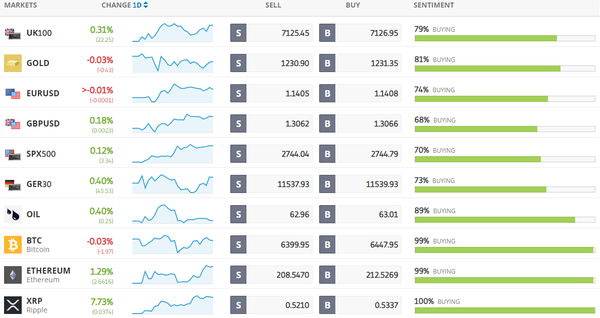

Todays Markets

|

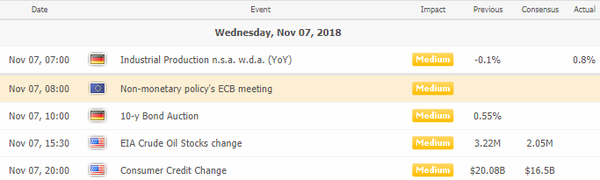

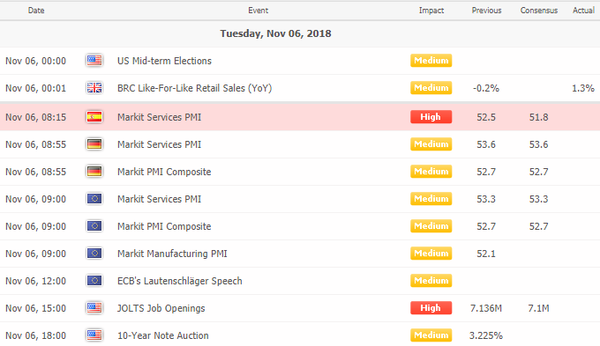

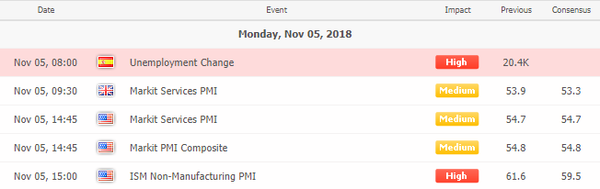

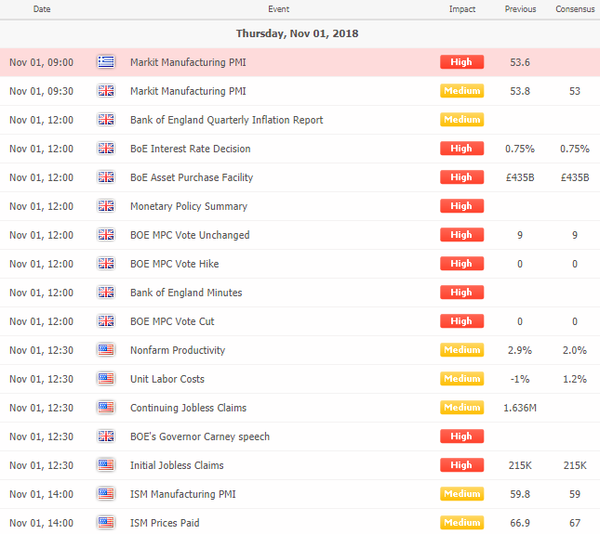

Economic Calendar

|

|

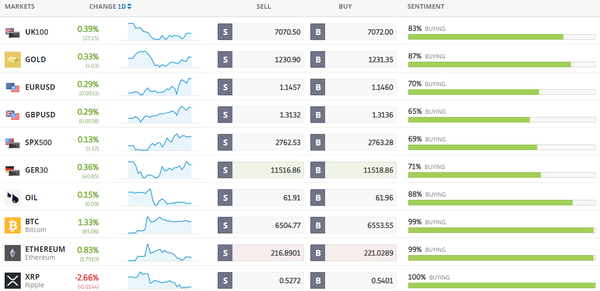

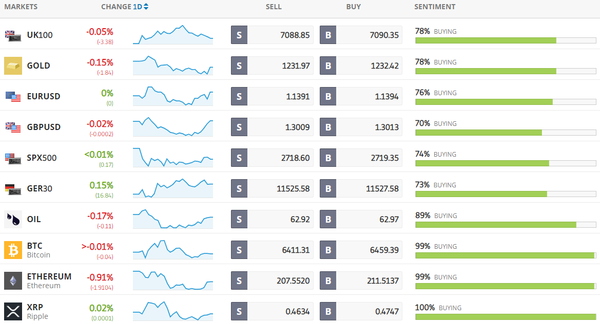

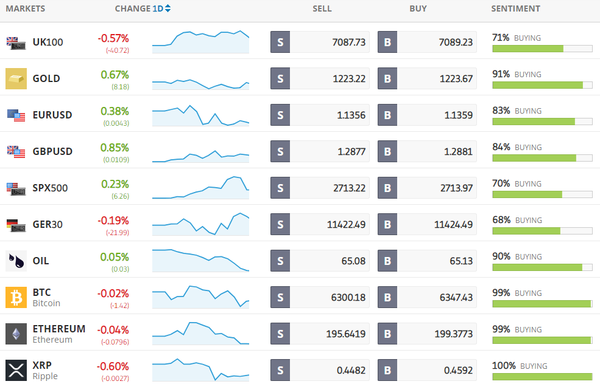

Trading Sentiment

Below is the latest sentiment as compiled by etoro, the world's largest (social) trading network. It provides a view of what individual investors think about the specific instruments and gives a view of the current sentiment.

|

|

Latest News Headlines

Bloomberg: A $240-Billion-a-Day Market Is Leaving London Over Brexit

The City of London is being dealt another Brexit blow. CME Group Inc. is moving its European market for short-term financing, the largest in the region, out of London because the exchange operator wants to guarantee continental firms can continue to use it if there is a no-deal Brexit. [more...]

Bloomberg: The Pound’s Rally May Be Ignoring a Big Risk

The pound’s rally this month on growing optimism for a Brexit agreement may be ignoring a big risk: getting any deal through Parliament. [more...]

Bloomberg: Stocks Lose Gains as Traders Mull a Split Congress: Markets Wrap

Asian equities and U.S. stock futures surrendered gains as investors mulled any implications for markets from American midterm election results that showed the anticipated split in Congress. The dollar retreated against most major peers and U.S. Treasury yields declined. [more...]

Bloomberg: Boeing Close to Issuing Safety Warning on 737 Max

Boeing Co. is preparing to send a safety warning to operators of its new 737 Max jets in response to the investigation of last week’s fatal crash off the coast of Indonesia that left 189 dead, said a person familiar with the matter. [more...]

Bloomberg: How Bill Gates Aims to Save $233 Billion by Reinventing the Toilet

Bill Gates thinks toilets are a serious business, and he’s betting big that a reinvention of this most essential of conveniences can save a half million lives and deliver $200 billion-plus in savings. [more...]

Bloomberg: Cohn Sees No ‘Instant Cure’ on U.S.-China Trade After Midterms

Gary Cohn, formerly President Donald Trump’s top economic adviser, said he doesn’t see a quick resolution to U.S.-China trade tensions after congressional elections. [more...]

Bloomberg: This Time, Stocks Got It Right. Now About That October Rout ...

For once, the consensus came true. Markets got it right and no violent repricing in equities was needed. A divisive episode of U.S. politics came and went, and investors are exactly where they were before. The question for bulls: can it actually last? [more...]

Bloomberg: A Market Guide to the Midterms

The U.S. midterm elections are upon us, and the results will have implications for everything from bond yields to equity volatility. Here’s a sampling of what strategists are saying about the outlook for markets. [more...]

Reuters: Wall Street futures up a tad after Democrats win U.S. House

U.S. stock futures pointed to a modestly higher opening on Wall Street on Wednesday after Democrats won control of the House of Representatives in U.S. mid-term congressional elections. [more...]

Reuters: Oil dips amid well-supplied market, Iran sanction waivers

Oil prices dipped on Wednesday as high output and U.S. sanction waivers allowing Iran’s biggest buyers to keep taking its crude reinforced the outlook for a well-supplied market. [more...]

CNBC: Democrats win back the House — victories will give party a check on Trump

Democrats will win control of the House, a triumph that gives the party real levers of power to check President Donald Trump and Senate Republicans, NBC News projects. [more...]

CNBC: Here’s what the US election results mean for Trump’s trade war with China

Tuesday’s U.S. midterm elections are poised to create significant changes for how President Donald Trump can accomplish his domestic goals, but the results may not mean much for the country’s trade policies. [more...] |

|

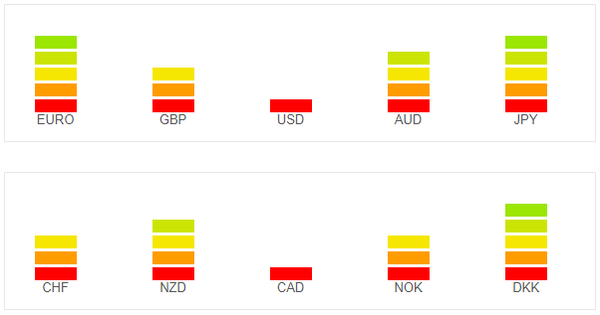

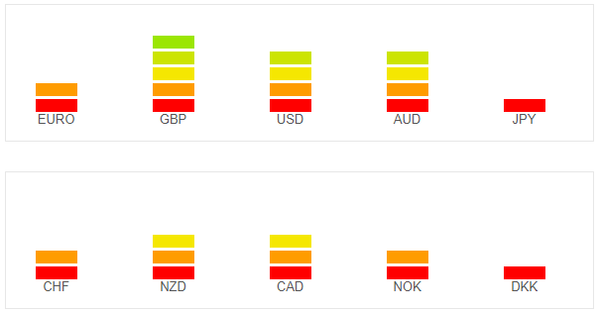

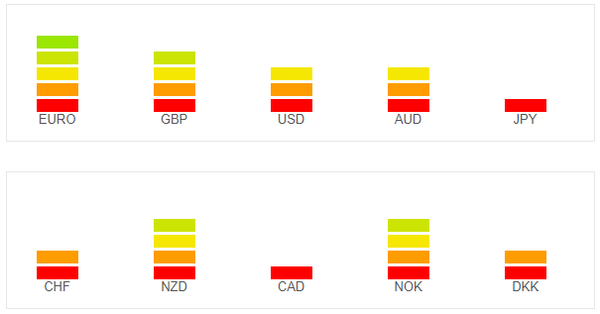

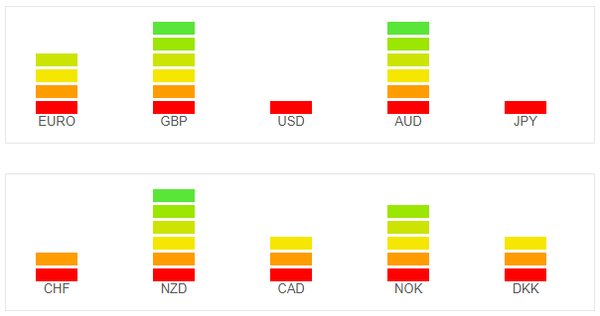

Currency Strength Indicators

|

|

The currency strength meter gives you a quick visual guide to which currencies are currently strong, and which ones are weak. The meter measures the strength of all forex cross pairs and applies calculations on them to determine the overall strength for each individual currency. For example, if EUR is strong and USD is weak, it could mean that the currency pair EURUSD could be going up. If both currencies are strong or weak it is better to avoid since it will probably means there is no clear direction for the specific pair.

Follow Us!