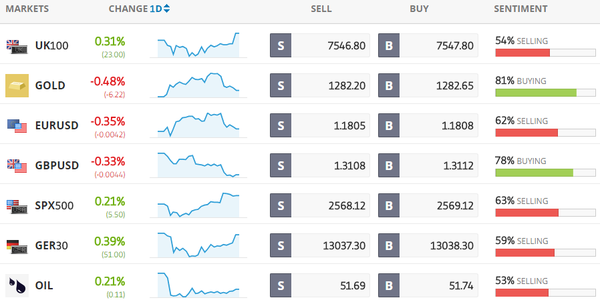

Todays Markets

|

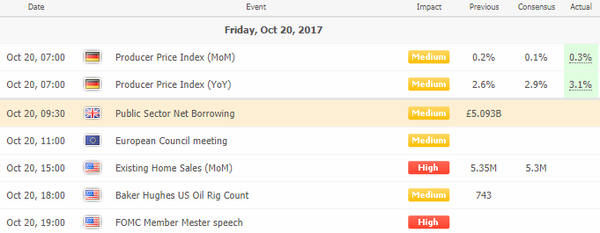

Economic Calendar

|

|

|

Trading Sentiment

Below is the latest sentiment as compiled by etoro, the world's largest (social) trading network. It provides a view of what individual investors think about the specific instruments and gives a view of the current sentiment.

|

|

|

Latest News Headlines

CNBC: Merkel sends positive signal to May on Brexit talks

German Chancellor Angela Merkel offered one of her most positive assessments of Brexit talks in months on Thursday, saying she believed negotiations between the EU and Britain were moving forward and dismissing the prospect of a breakdown. [more...]

Bloomberg: Dollar Gains, Treasuries Fall on U.S. Tax Hopes: Markets Wrap

The dollar climbed as Treasuries fell after the latest developments in Washington buoyed optimism about the chances for American tax cuts. Stocks in Asia halted a rally after global equities reached records during the week. [more...]

Bloomberg: Fewest Jobless Claims Since 1973 Show Firm U.S. Job Market

Filings for unemployment benefits plunged last week to the lowest level since 1973 as workers affected by hurricanes Harvey and Irma continued to return to their jobs, Labor Department figures showed Thursday. [more...]

Bloomberg: Markets Show a Craving for Status Quo After Fed Chair Race Narrows

If you need evidence that the market would reward policy continuity at the Federal Reserve, look no further to the fact that Treasuries surged and stocks pushed higher after a report that Fed Governor Jerome Powell is the “leading candidate” to helm the central bank. [more...]

Bloomberg: How New Wealth, Few Rules Fuel Family-Office Boom

The descendants of oil tycoon John D. Rockefeller have them. So do Microsoft Corp. founder Bill Gates and hedge-fund manager Bill Ackman. They are family offices, the loosely regulated, privately owned companies that manage vast amounts of money for wealthy clans. [more...]

Bloomberg: The Global Market View on New Zealand's New Government: Don't Panic

Expect further declines for New Zealand’s currency in the short term, look for buying opportunities on dips, and trust that the country’s solid economic fundamentals will reassert themselves. [more...]

Reuters: Asian shares perk up after U.S. Senate passes budget plan

Asian shares shrugged off early sluggishness and gained on Friday, and the dollar rose after the U.S. Senate approved a budget blueprint for the 2018 fiscal year that will pave the way for Republicans to pursue a tax-cut package without Democratic support. [more...]

Reuters: Oil rises on tighter fundamentals, but China warning holds back market

Oil prices edged up on Friday, supported by signs of tightening supply and demand fundamentals, although a warning about excessive China economic optimism still weighed somewhat on markets. [more...]

CNBC: The massive Saudi Aramco IPO doesn't look like a great investment to many

Oil giant Saudi Aramco is readying what's set to be the biggest initial public offering ever. But as it turns out, investors might not be all that interested. [more...] |

|

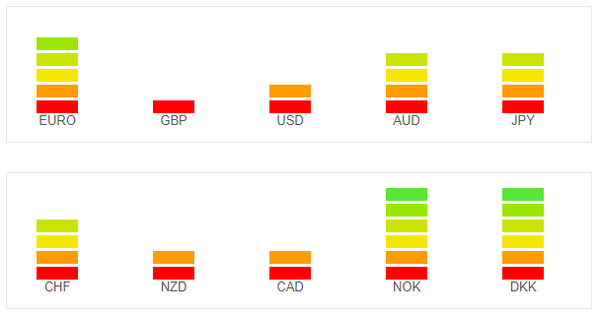

Currency Strength Indicators

|

|

Trade with the Trend! Join today by clicking below and know which way to trade by accessing our market directional signal!

Disclaimer Notice

Past performance is not indicative of future results. Trading stocks, options, forex, CFDs and equites carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts.

The information provided by Edvesting.com should not be relied upon as a substitute for extensive independent research which should be performed before making your investment decisions. Edvesting.com are merely providing this information for your general information. The information and opinions presented do not take into account any particular individual's investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision and should tailor the trade size and leverage of their trading to their personal risk appetite.

Edvesting.com and/or its owners will not be responsible for any losses incurred on investments made by readers and clients as a result of any information contained on Edvesting.com. Edvesting.com does not render investment, legal, accounting, tax, or other professional advice. If investment, legal, tax, or other expert assistance is required, the services of a competent professional should be sought.

Leave a Reply

Want to join the discussion?Feel free to contribute!