Todays Markets

|

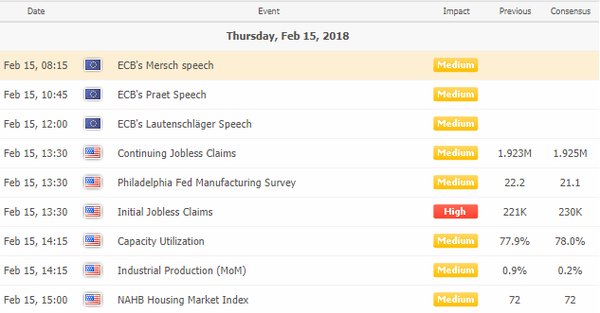

Economic Calendar

|

|

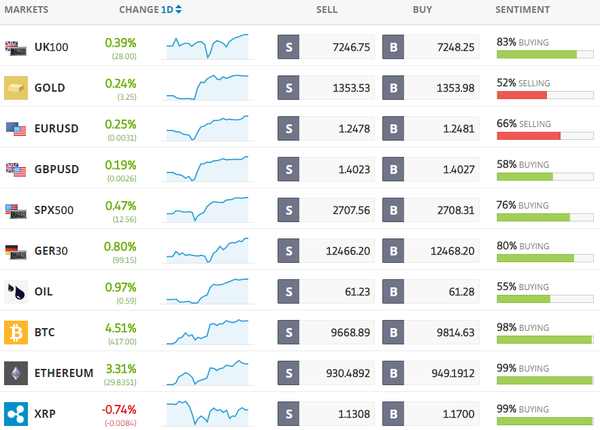

Trading Sentiment

Below is the latest sentiment as compiled by etoro, the world's largest (social) trading network. It provides a view of what individual investors think about the specific instruments and gives a view of the current sentiment.

|

|

Latest News Headlines

Bloomberg: Yen Extends Gain as Stocks in Asia Run With Rally: Markets Wrap

The yen extended an advance and a rally in global stocks continued in Asia as equity investors showed signs of warming to a world with inflation and a sustained pace of tightening in U.S. monetary policy following this month’s slide in risk assets. [more...]

Bloomberg: Dollar Under Siege With U.S. Deficits Back on Wall Street's Radar

America’s fiscal largesse and the specter of wider current-account shortfalls are fueling a renewed wave of dollar bashing. [more...]

Bloomberg: Australian Employment Edges Higher Even as Full-Time Jobs Slump

Australian employment edged higher in the first month of the year, despite a plunge in full-time jobs, suggesting the central bank is likely to keep interest rates on hold. [more...]

Bloomberg: Yen Bulls Betting on BOJ Bask in Stock Rout, Add to Wagers

Yen bulls who were betting the Bank of Japan will edge away from monetary stimulus are basking in this month’s global stock slump, which has propelled the currency to the strongest in 15 months. [more...]

Bloomberg: That Obsession With Inflation Didn't Last Long

A $2 trillion rout in U.S. equities knocked investors out of a trance of profit euphoria. And they suddenly found themselves latching onto inflation as the thing to obsess about -- until January’s CPI print came out Wednesday and they decided they weren’t interested in it, after all. [more...]

Bloomberg: Will the Fed Soon Signal Four Hikes in 2018? Don't Bet on It

U.S. inflation is perking up. And just like that, commentators are speculating the Federal Reserve may raise interest rates more times than the three moves they’ve penciled in for this year. [more...]

Bloomberg: Dollar Bears Dominate at FX-Market Forum

Sell the dollar. That’s the message from almost all the money managers and strategists who spoke at TradeTech FX, a gathering of more than 500 currency-market participants in Miami this week. [more...]

Reuters: Stocks climb despite rise in U.S. inflation; dollar on defensive

Asian stocks rose on Thursday after Wall Street brushed aside strong U.S. inflation data and surged, in a move that also saw the dollar pinned to two-week lows even as Treasury yields jumped in anticipation of more rapid U.S. interest rate hikes. [more...]

Reuters: Oil extends gains on Saudi commitment to cutting output, weak dollar

Oil prices rose more than 1 percent on Thursday to extend gains from the previous session, lifted by a weak dollar and Saudi comments that it would rather see an undersupplied market than end a deal with OPEC and Russia to withhold production. [more...]

Reuters: Dollar hits 15-month low vs. yen, some see further slide

The dollar extended its losses against the yen and hit a new 15-month low on Thursday, with market participants bracing for further near-term weakness in the U.S. currency. [more...]

CNBC: Apple said it wants to become 'cash neutral' - which could be a huge boost for earnings

Apple's earnings could pop as much as 30 percent higher than current estimates — if the company buys back 10 percent of its shares each year over the next several years. [more...]

CNBC: Asian stocks advance following sharp US gains; yen firms

The Nikkei 225 rose 1.47 percent, or 310.81 points, to close at 21,464.98. Most sectors were in positive territory despite the firmer yen, with technology and financials recording substantial gains. [more...] |

|

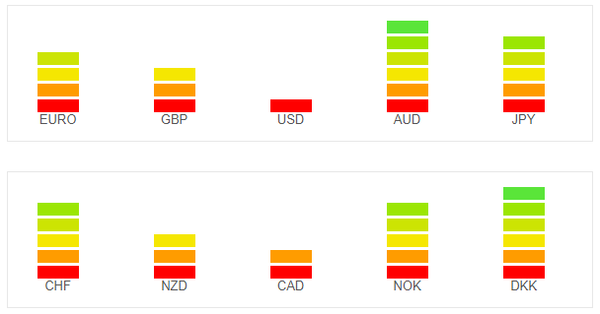

Currency Strength Indicators

|

|

The currency strength meter gives you a quick visual guide to which currencies are currently strong, and which ones are weak. The meter measures the strength of all forex cross pairs and applies calculations on them to determine the overall strength for each individual currency. For example, if EUR is strong and USD is weak, it could mean that the currency pair EURUSD could be going up. If both currencies are strong or weak it is better to avoid since it will probably means there is no clear direction for the specific pair. To get the latest Currency Strength Indicator please click here

Leave a Reply

Want to join the discussion?Feel free to contribute!