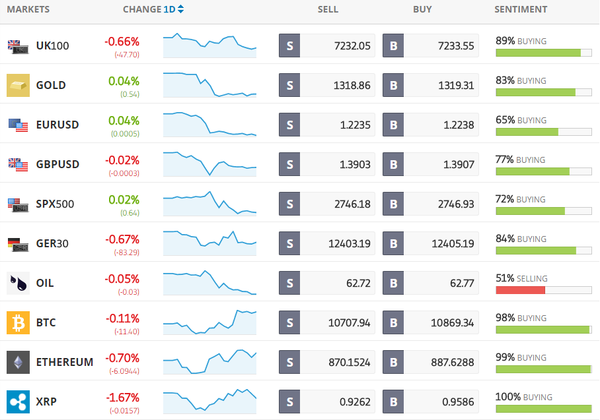

Todays Markets

|

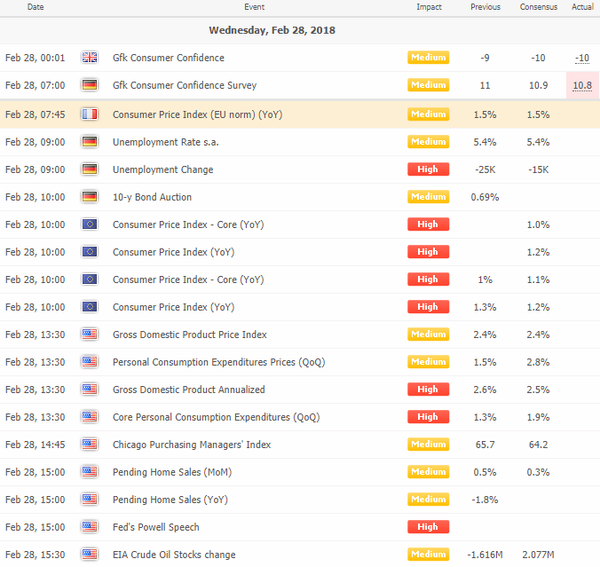

Economic Calendar

|

|

Trading Sentiment

Below is the latest sentiment as compiled by etoro, the world's largest (social) trading network. It provides a view of what individual investors think about the specific instruments and gives a view of the current sentiment.

|

|

Latest News Headlines

Bloomberg: Stocks Sell Off on Powell, Poor Data; Yen Climbs: Markets Wrap

Stocks in Asia followed their U.S. counterparts lower after hawkish comments from Federal Reserve Chair Jerome Powell and weaker-than-expected economic data from China and Japan. The yen strengthened after the Bank of Japan reduced longer-dated bond purchases. [more...]

Bloomberg: Five Things You Need to Know to Start Your Day

New Federal Reserve Chairman Jerome Powell sent markets moving with his upbeat economic assessment for the U.S. and the world, while China plans to cut its budget-deficit target for the first time since 2012. Here are some of the things people in markets are talking about. [more...]

Bloomberg: Bond Traders Ponder Four Fed Hikes in 2018 After Powell’s Remarks

The U.S. Treasuries curve from five to 30 years flattened and two-year yields approached their highest levels since 2008 after Powell answered a question about what it would take to raise rates more aggressively than the three 2018 hikes that the Federal Open Market Committee projected in December. [more...]

Bloomberg: Ultra Wealthy Are Being Lured to Italy by Low Tax Rates

In an effort to attract capital, Italy unveiled a measure last year allowing ultra-wealthy individuals taking up residency to pay a flat tax of 100,000 euros ($123,000) a year, regardless of their income. [more...]

Bloomberg: Here's What We Learned From Powell's First Fed Chair Testimony

Federal Reserve Chairman Jerome Powell appeared Tuesday before the House Financial Services Committee, his first testimony since he took charge earlier this month. He moved markets with his upbeat economic assessment, and also dropped some hints about how his views and style might differ from his predecessor, Janet Yellen. [more...]

Bloomberg: Bond Market Déjà Vu? Here's What Will Reveal If Rout Has Legs

After the benchmark 10-year U.S. note yield hit 2.9537 percent on Feb. 21, a four-year high, it seemed inevitable that 3 percent was in the cards. Yet buyers emerged, some Wall Street strategists trumpeted their bullish views once more and suddenly the “bond bear market” doesn’t have quite so much momentum. [more...]

Bloomberg: The Crypto-Futures Revolution Is Just Starting

Futures linked to cryptocurrencies besides Bitcoin may have just gotten a step closer to reality. Cboe Global Markets Inc., which introduced Bitcoin futures in December, finished upgrading the technology at its futures exchange over the weekend, according to a statement Tuesday. [more...]

Reuters: Asian shares slide as weak China, Japan manufacturing data add to Fed worries

Asian shares extended losses on Wednesday as weak Chinese and Japanese manufacturing data revived worries about global growth amid anxiety over faster rate rises in the United States. [more...]

Reuters: Fed's Powell nods to stronger economy, backs gradual rate hike path

Federal Reserve Chairman Jerome Powell, in his first public appearance as head of the U.S. central bank, vowed on Tuesday to prevent the economy from overheating while sticking with a plan to gradually raise interest rates. [more...]

CNBC: Signs point to the Japanese yen getting even stronger as the US dollar weakens

The Japanese yen's rapid appreciation since the start of 2018 has made it one of the best-performing currencies so far — and there's room for further strengthening. [more...] |

|

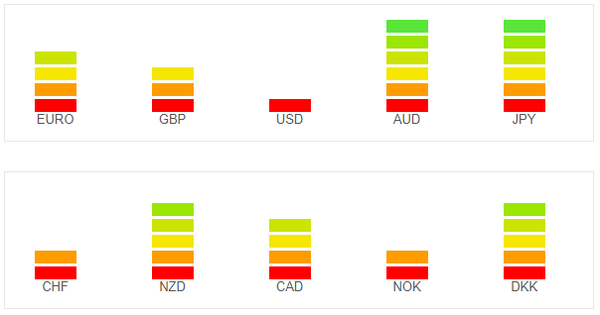

Currency Strength Indicators

|

|

The currency strength meter gives you a quick visual guide to which currencies are currently strong, and which ones are weak. The meter measures the strength of all forex cross pairs and applies calculations on them to determine the overall strength for each individual currency. For example, if EUR is strong and USD is weak, it could mean that the currency pair EURUSD could be going up. If both currencies are strong or weak it is better to avoid since it will probably means there is no clear direction for the specific pair. To get the latest Currency Strength Indicator please click here

Leave a Reply

Want to join the discussion?Feel free to contribute!