Todays Markets

|

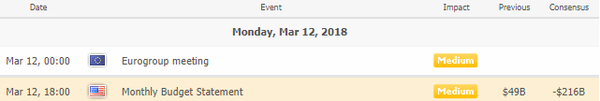

Economic Calendar

|

|

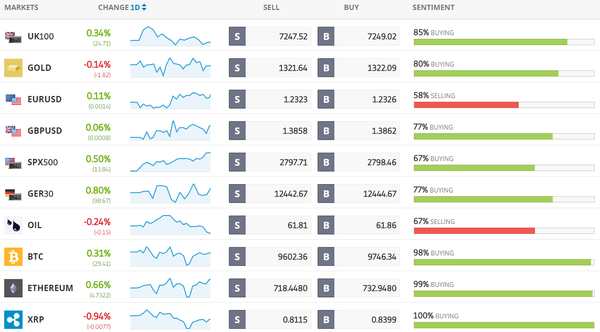

Trading Sentiment

Below is the latest sentiment as compiled by etoro, the world's largest (social) trading network. It provides a view of what individual investors think about the specific instruments and gives a view of the current sentiment.

|

|

Latest News Headlines

Bloomberg: Stocks in Asia Rally After U.S. Jobs; Yen in Focus: Markets Wrap

Asian stocks gained as trade-war concerns took a backseat to economic optimism following a U.S. jobs report Friday that showed the American economy continued to strengthen without the prior month’s rapid wage gains that stoked inflation fears. [more...]

Bloomberg: U.S. Added 313,000 Jobs in February; Wage Gains Cool to 2.6%

The U.S. economy enjoyed the biggest hiring spree since mid-2016 in February as workers streamed in from the sidelines of the labor force, but inflation pressures remained muted amid signs the pay gains that spooked financial markets last month haven’t taken hold. [more...]

Bloomberg: Five Things You Need to Know to Start Your Day

China signs off on unlimited presidential terms, equity markets look set to kick off the week with a strong start, and the Bank for International Settlements flags risks within economies from Canada to China. Here are some of the things people in markets are talking about. [more...]

Bloomberg: Japan Finance Minister Under Fire as Abe School Scandal Deepens

Japanese Finance Minister Taro Aso is coming under pressure to resign as a scandal over alleged favors to a school with connections to Japanese Prime Minister Shinzo Abe deepened. [more...]

Bloomberg: Middle East's Biggest Bank Jumps on Plans to Lift Foreign Limit

Qatar National Bank shares surged as the biggest lender in the Middle East and North Africa by assets seeks to almost double its foreign ownership limit. The stock jumped as much as 7.6 percent, the biggest intraday advance in more than two years. It traded 6.8 percent higher at 126 riyals at 10:09 a.m. in Doha. [more...]

Bloomberg: Pound Traders Take Break From Brexit as Fiscal Policy in Focus

Sterling barely moved last week on Brexit speeches by European Union President Donald Tusk and U.K. Chancellor Philip Hammond. This week sees Hammond in the spotlight for a different reason: U.K. fiscal policy. [more...]

Reuters: Asia shares rally as U.S. job data revive risk appetite

A relief rally swept across Asian share markets on Monday after the latest U.S. jobs report managed to impress with its strength while also easing fears of inflation and faster rate hikes, a neat feat that whetted risk appetites globally. [more...]

Reuters: Oil edges up on reduced U.S. drilling activity, booming job market

Oil markets edged up on Monday on the back of a drop in the number of U.S. rigs drilling for more production and as the U.S. economy continued to create jobs, which industry hopes will drive higher fuel demand. [more...]

Reuters: China says trade war with U.S. will only bring disaster to global economy

Any trade war with the United States will only bring disaster to the world economy, Chinese Commerce Minister Zhong Shan said on Sunday, as Beijing stepped up its criticism on proposed metals tariffs by Washington amid fears it could shatter global growth. [more...]

CNBC: In India, 'fake news' and hoaxes catch fire as millions see YouTube for the first time

YouTube is tackling hoaxes and other problems that plague it in much of the developed world, but it's falling short in a booming new market. In India, fake news, hoaxes and other misleading videos have thrived on Google's video platform with little friction for years. [more...]

CNBC: From 'graveyards' to 'debtbergs,' David Stockman renews his stern warnings for Wall Street

David Stockman is delivering a fresh round of dire Wall Street warnings. Even though the markets have been battling back from the Feb. 2 correction, President Ronald Reagan's former OMB director warns the market has hit an inflection point. [more...] |

|

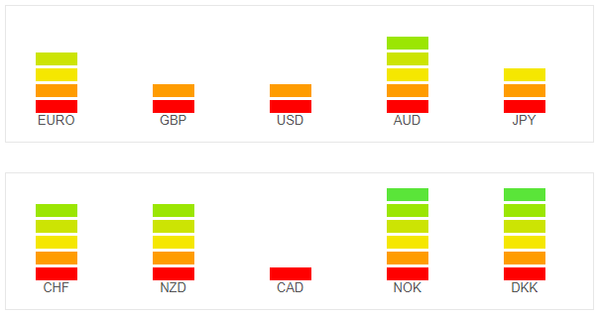

Currency Strength Indicators

|

|

The currency strength meter gives you a quick visual guide to which currencies are currently strong, and which ones are weak. The meter measures the strength of all forex cross pairs and applies calculations on them to determine the overall strength for each individual currency. For example, if EUR is strong and USD is weak, it could mean that the currency pair EURUSD could be going up. If both currencies are strong or weak it is better to avoid since it will probably means there is no clear direction for the specific pair. To get the latest Currency Strength Indicator please click here

Leave a Reply

Want to join the discussion?Feel free to contribute!