Todays Markets

|

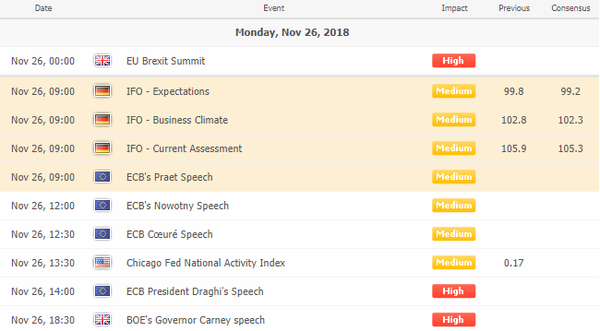

Economic Calendar

|

|

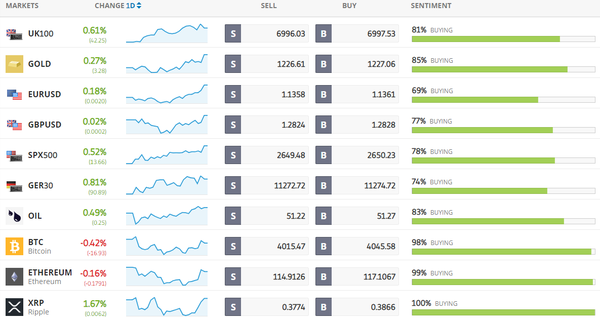

Trading Sentiment

Below is the latest sentiment as compiled by etoro, the world's largest (social) trading network. It provides a view of what individual investors think about the specific instruments and gives a view of the current sentiment.

|

|

Latest News Headlines

Bloomberg: Will May Get Her Deal Passed The Second Time? Markets Think So

The British Parliament will probably reject Prime Minister Theresa May’s Brexit deal, but then approve it on a second attempt amid market pressure, according to UBS Wealth Management’s chief economist Paul Donovan. He reckons that prediction is now the consensus view in financial markets. [more...]

CNBC: Brexit withdrawal agreement approved by EU leaders

EU leaders backed Theresa May’s Brexit withdrawal agreement on Sunday, setting up a showdown with lawmakers in her own country as the U.K. leader nears a crucial vote on her proposals. [more...]

Bloomberg: Global Stock Slump Wanes; Oil Prices Stabilize: Markets Wrap

Stocks began the last week of November on a positive footing, with most Asian benchmarks higher and U.S. equity futures advancing after last week’s tumble. Oil prices also made a run at stabilizing, with West Texas crude putting some distance from the $50 a barrel mark. [more...]

Bloomberg: Grim Stock Signals Piling Up as Wall Street Mulls Recession Odds

Nine turbulent weeks and a correction in U.S. stocks have left analysts with a thorny question. What’s the market saying about the economy? And while few see incontrovertible signs investors are bracing for a recession, it’s a word that’s been coming up more as they seek a signal in the chaos. [more...]

Bloomberg: Vegas Is Now Home to the ‘World’s Biggest’ Weed Store. Of Course It Is

Come for the giant neon lotus flowers, stay for the weed. That’s the pitch from Planet 13, a Las Vegas marijuana dispensary that bills itself as the world’s largest. Housed in a 40,000-square-foot (3,700-square-meter) building—with retail space, back offices and room for weed cultivation—the store opened earlier this month just off the Strip in the shadow of the Palazzo, Treasure Island and the Wynn. [more...]

Bloomberg: Bitcoin's Deepening Crash Now Rivals Its Worst-Ever Bear Markets

Bitcoin’s tumble worsened over the weekend, putting the 2018 crash within striking distance of the cryptocurrency’s worst-ever bear markets. The virtual currency, conceived just over a decade ago, fell as low as $3,475 on Sunday, Bitstamp prices show. [more...]

Bloomberg: World's Fiscal Policies Ease as Easy-Money Era Ends

Global governments are doing the most to propel the world economy in a decade just as growth slows. As leaders from the Group of 20 prepare to meet this week in Argentina, JPMorgan Chase & Co. economists calculate easier fiscal policy will add 0.3 percentage point to global gross domestic product next year, the biggest impulse this decade. [more...]

Bloomberg: The Xi-Trump Meeting May Be a Watershed for Emerging Markets

With the U.S.-China trade dispute still very much a wild card, this week’s meeting between President Donald Trump and Xi Jinping of China may turn out to be a watershed moment for emerging markets. [more...]

Bloomberg: Does Brexit Mean Brexit? EU Judges Could Play Pivotal Role

As U.K. Prime Minister Theresa May strives to get her Brexit deal through Parliament, lawsuits are piling up with the potential to change the course of the nation’s biggest constitutional crisis since the 1930s. [more...]

Bloomberg: Goldman Models Impact of Rate-Shock Scenarios on Markets

Goldman Sachs Group Inc. economists have proposed some “rules of thumb” for the impact of Federal Reserve interest-rate hikes on financial conditions and the U.S. economy, which showcase the importance of policy makers’ communications. [more...]

Bloomberg: Betting on Stronger Euro May Have a Limited Shelf Life

Betting on a stronger euro may have a limited shelf life as its long term prospects remain bearish. Any move higher in the common currency may meet selling pressure as soft euro-zone data and the ongoing rift between Italy and the European Commission cancel out bets on fewer Federal Reserve interest-rate hikes. [more...]

Reuters: Trump is right, jobs for black Americans abound. Here's why it may not last

Ask Memphis residents and they might say that President Donald Trump got this one right: this is the best job market as far as many in this majority black city can remember. [more...]

Reuters: Shares tick up on U.S. holiday sales hopes, but oil rout checks enthusiasm

Asian stocks and U.S. equity futures posted modest gains on Monday on hopes of solid U.S. holiday sales, though risk appetite was tempered as plunging oil prices fanned worries about the global economic outlook. [more...]

CNBC: Where to put your money in 2019 — it’s not US stocks, according to Morgan Stanley

Stocks in emerging markets have had a rough year — but that could change considerably next year, Morgan Stanley said in its Global Strategy Outlook report for 2019. [more...] |

|

|

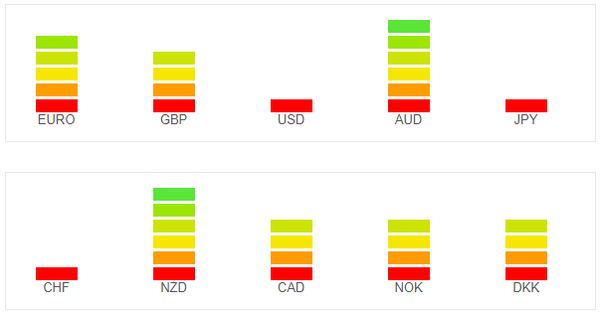

Currency Strength Indicators

|

|

The currency strength meter gives you a quick visual guide to which currencies are currently strong, and which ones are weak. The meter measures the strength of all forex cross pairs and applies calculations on them to determine the overall strength for each individual currency. For example, if EUR is strong and USD is weak, it could mean that the currency pair EURUSD could be going up. If both currencies are strong or weak it is better to avoid since it will probably means there is no clear direction for the specific pair.

Leave a Reply

Want to join the discussion?Feel free to contribute!