Todays Markets

|

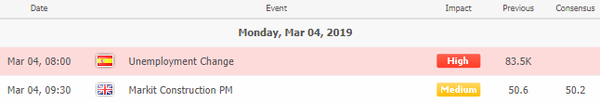

Economic Calendar

|

|

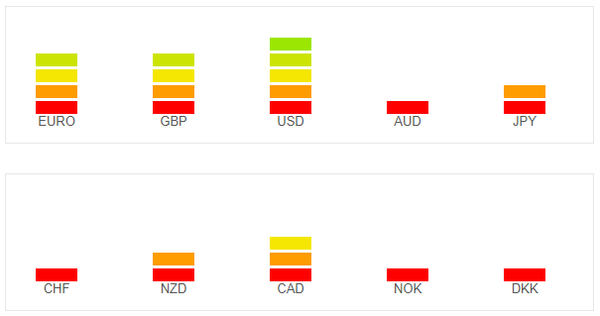

Trading Sentiment

Below is the latest sentiment as compiled by etoro, the world's largest (social) trading network. It provides a view of what individual investors think about the specific instruments and gives a view of the current sentiment.

|

|

|

Latest News Headlines

|

|

Bloomberg: Stocks Climb With Yuan on Trade-Deal Optimism: Markets Wrap

Asian stocks rose with U.S. futures, and the yuan advanced after a report that the U.S. and China are close to a trade deal that may end American tariffs. The dollar fluctuated and Treasuries dipped. [more...]

Bloomberg: U.S. and China Near Deal That Could End Most U.S. Tariffs

The U.S. and China are close to a trade deal that could lift most or all U.S. tariffs as long as Beijing follows through on pledges ranging from better protecting intellectual-property rights to buying a significant amount of American products, two people familiar with the discussions said. [more...]

Bloomberg: SpaceX Crew Dragon Docks With International Space Station

SpaceX’s Crew Dragon unmanned craft successfully docked with the International Space Station on Sunday, a key milestone for chief executive officer Elon Musk, his team and the American space agency. [more...]

Bloomberg: Dollar to Defy Angry Trump on Allure of U.S. Yields, Funds Say

President Donald Trump may have to work a lot harder if he wants to talk down the dollar. The U.S. currency is poised to remain strong this year despite Trump’s complaints about its recent gains as Treasuries remain the best option for yield-hungry investors and growth elsewhere is lackluster, according to money managers including Grant Samuel Funds Management Pty and QIC Ltd. [more...]

Bloomberg: The Yen Is Still Sliding, Despite the Bulls

The world and its mother is convinced Japan’s currency is going to strengthen -- it’s just that nobody seems to have taken the time to tell the still-weakening yen. [more...]

Bloomberg: Bill Gross Sees ‘Much Less’ Alpha in Era of QE and Quant Trading

Think of it as a parting shot to anyone hoping to be the next king of bonds. Bill Gross, who defined his investing career by beating benchmarks, says the era of outperformance is largely over. [more...]

Bloomberg: Oil Slump Catches Funds Off Guard in Longest Bull Run Since 2012

Oil’s sudden slump seems to have caught optimists by surprise. Hedge funds increased wagers on rising Brent crude prices for an eighth straight week, the longest streak since 2012, according to ICE Futures Europe data for the seven days through Feb. 26. [more...]

Bloomberg: Global Stocks Could See 10% Trade Discount Narrow on Deal

Global stocks are currently trading at a 10 percent discount thanks to the trade war -- a gap which could eventually close if reports the U.S. and China are close to a deal are accurate. [more...]

Reuters: U.S. and China said to appear close to deal to roll back tariffs

The United States and China appear close to a deal that would roll back U.S. tariffs on at least $200 billion worth of Chinese goods, as Beijing makes pledges on structural economic changes and eliminates retaliatory tariffs on U.S. goods, a source briefed on negotiations said on Sunday. [more...]

Reuters: Slowdown to showdown: Five questions for the ECB

Two months after ending its massive stimulus scheme, the European Central Bank faces growing pressure to address how it will protect the euro zone economy from a protracted slowdown. [more...]

CNBC: Goldman Sachs takes a look at what a US-China trade deal might look like

The U.S. and China appear more likely to reach some sort of trade agreement during an expected meeting between their two presidents later this month — but some tariffs would most probably be kept in place, predicted Goldman Sachs in a report on Monday. [more...]

CNBC: After Trump walked out on Kim Jong Un, don't expect a US-China trade deal

The bizarre summit meetings between the U.S. and North Korea came to a logical end. Without any security guarantees and relief from debilitating sanctions, Pyongyang refused last Thursday in Hanoi, Vietnam to destroy its nuclear military assets and their delivery vehicles. [more...] |

|

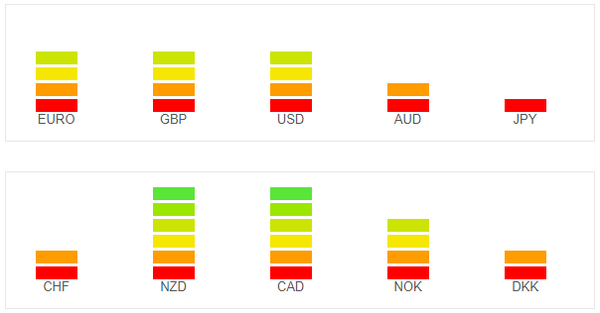

Currency Strength Indicators

|

|

The currency strength meter gives you a quick visual guide to which currencies are currently strong, and which ones are weak. The meter measures the strength of all forex cross pairs and applies calculations on them to determine the overall strength for each individual currency. For example, if EUR is strong and USD is weak, it could mean that the currency pair EURUSD could be going up. If both currencies are strong or weak it is better to avoid since it will probably means there is no clear direction for the specific pair.

Leave a Reply

Want to join the discussion?Feel free to contribute!