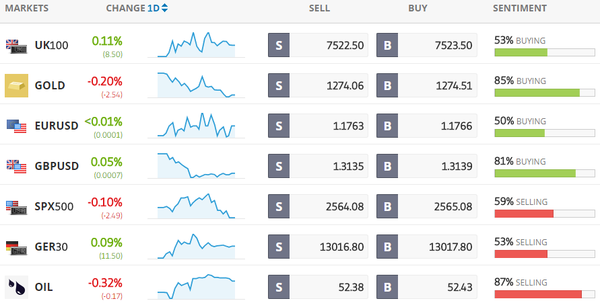

Todays Markets

|

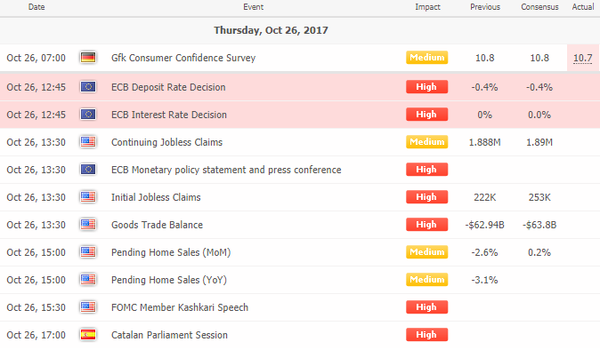

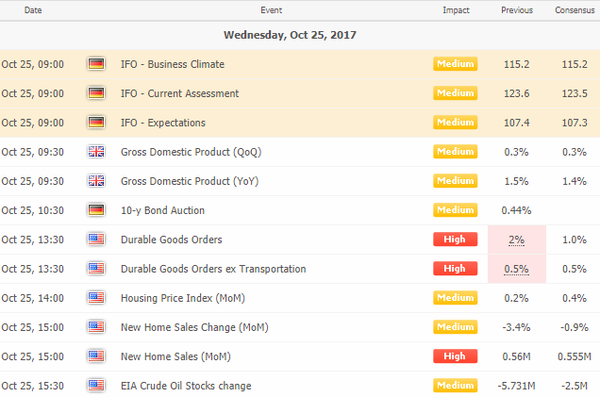

Economic Calendar

|

|

|

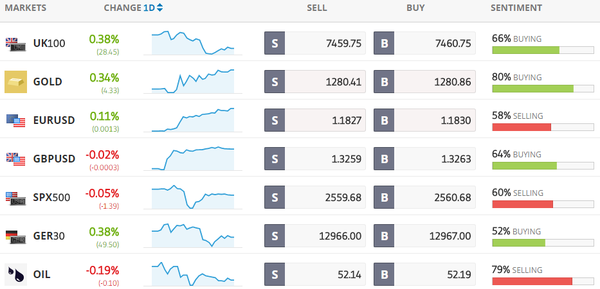

Trading Sentiment

Below is the latest sentiment as compiled by etoro, the world's largest (social) trading network. It provides a view of what individual investors think about the specific instruments and gives a view of the current sentiment.

|

|

|

Latest News Headlines

Bloomberg: Stocks in Asia Fluctuate as Earnings, ECB in Focus: Markets Wrap

Stocks in Asia were mixed following the biggest declines in seven weeks on Wall Street as uneven corporate earnings keep traders on edge ahead of reports from technology giants, banks and a European Central Bank meeting. The dollar extended losses against G10 peers. [more...] Bloomberg: Inside Apple’s Struggle to Get the iPhone X to Market on Time Bloomberg: China’s Silk Road Cuts Through Some of the World’s Riskiest Countries

Bloomberg: Nordea to Cut ‘at Least’ 6,000 Jobs in Fight to Stay Competitive

Nordea Bank AB said it will need to cut at least 6,000 jobs as the Nordic region’s largest lender struggles to stay competitive. [more...]

Bloomberg: Global Risks, Singapore's Central Bank Warns

Investors are underestimating risks to the global economy as they drive stock markets to record highs, Singapore’s central bank chief warned. [more...]

Bloomberg: Pound Reverses Decline as U.K. Economy Grows More Than Forecast

The pound strengthened, reversing an earlier decline against the dollar, after data showed the U.K. economy expanded more than forecast in the third quarter, reinforcing expectations that the Bank of England will raise interest rates next week. [more...]

Bloomberg: The Bond-Market Doomsday Is a Dud to Traders Eyeing Opportunity to Buy

After 10-year Treasury yields broke through 2.4 percent, then 2.42 percent, then 2.45 percent on Tuesday and Wednesday, it looked like the market was buckling under the weight of what DoubleLine Capital LP’s Jeffrey Gundlach called “the moment of truth” for its three-decade bull run. [more...]

Reuters: Euro edges up with ECB decision in focus, Asian stocks flat

The euro stretched gains on Thursday ahead of a European Central Bank meeting that could result in a less accommodative monetary policy, while Asian stocks were subdued after Wall Street pulled back from record highs. [more...]

Reuters: Oil prices inch lower on increases in U.S. crude inventories, production

Oil prices inched lower on Thursday, pressured by an unexpected increase in U.S. crude inventories and as oil output and exports from the United States rose last week. [more...]

CNBC: China has launched another crackdown on the internet — but it's different this time

Chinese President Xi Jinping delivered a message for the world during his opening speech at the 19th Communist Party Congress: China supports an open economy, and it will further liberalize its markets to foreign investors. [more...]

CNBC: Deutsche Bank profits more than double and smash market estimates

German lender Deutsche Bank posted a strong increase in third-quarter net profit Thursday, beating analyst expectations despite a significant drop in investment bank revenue. [more...] |

|

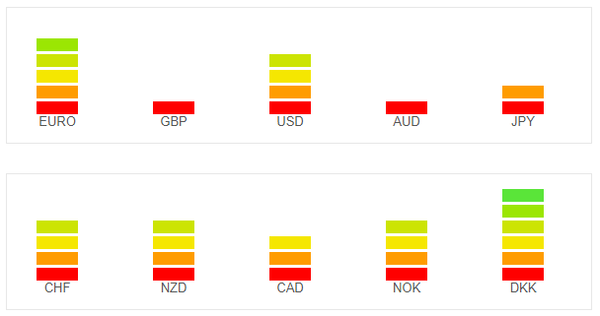

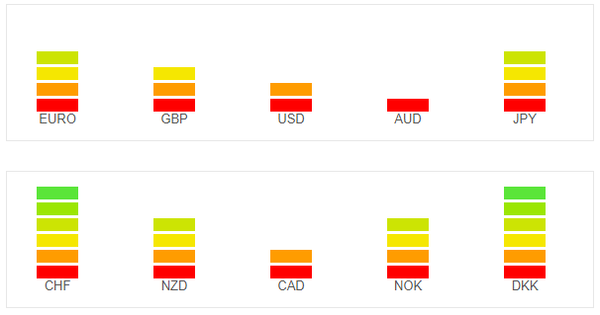

Currency Strength Indicators

|

|

Follow Us!