Todays Markets

/0 Comments/in Day Trading Signals /by admin|

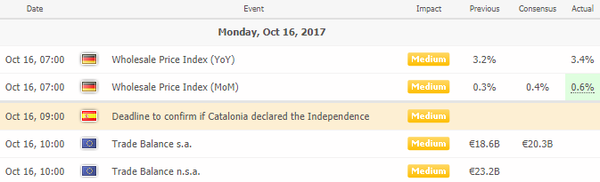

Economic Calendar

|

|

|

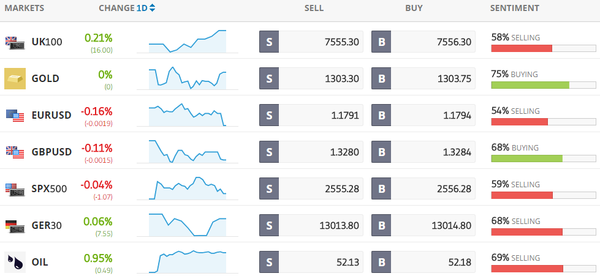

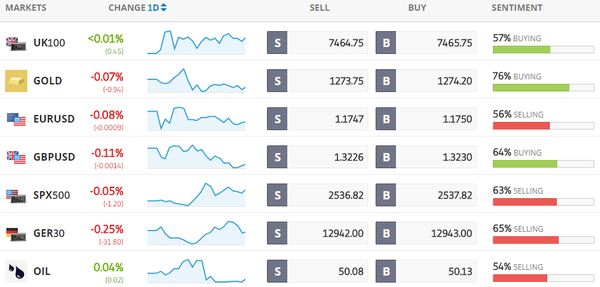

Trading Sentiment

Below is the latest sentiment as compiled by etoro, the world's largest (social) trading network. It provides a view of what individual investors think about the specific instruments and gives a view of the current sentiment.

|

|

|

Latest News Headlines

Bloomberg: Stocks in Asia Advance After U.S. Inflation Data: Markets Wrap

Stocks in Asia advanced with bonds after inflation data in the U.S. added to evidence that global growth is continuing steadily with limited price pressures in the American economy. [more...]

Bloomberg: Good News About Brexit: Leaving London and Paying Less Rent

Bankers and others who must relocate in the wake of the Brexit vote may miss London, but not its rents. In destinations including Frankfurt, Paris and Dublin, their housing costs could be slashed as much as 60 percent. [more...]

Bloomberg: What Global Finance Chiefs Are Saying About the Economy

Don’t celebrate too soon. That was the key message as policy makers and investors left Washington on Sunday after attending the annual meetings of the International Monetary Fund and World Bank. [more...]

Bloomberg: China's Central Bank Chief Warns Corporate Debt Is Too High

People’s Bank of China Governor Zhou Xiaochuan warned that Chinese companies have taken on too much debt, and argued for less financial leverage as well as fiscal reforms to constrain local government borrowing. [more...]

Bloomberg: In China, Trading Begins on WeChat

In China, bankers and traders don’t just hit the phones or send an email when they have a deal to sell. They take to WeChat. [more...]

Bloomberg: This Is the Week Wall Street Went Nuts Over Cryptocurrencies

Wall Street banks that weren’t already on the bitcoin bandwagon appear to be piling in, or at least eyeing seats, after the cryptocurrency surged to all-time highs this week on the way to $6,000. [more...]

Reuters: Asian shares conquer 10-year peak, oil up on Iraq tensions

Asian shares advanced to a decade high on Monday, while U.S. oil futures jumped to hover near a six-month top as escalating tensions between the Iraqi government and Kurdish forces threatened supply. [more...]

Reuters: Oil jumps on fears of new Iran sanctions, Iraq conflict

Oil markets jumped on Monday on concerns over potential renewed U.S. sanctions against Iran as well as conflict in Iraq, while an explosion at a U.S. oil rig and reduced exploration activity supported prices there. [more...]

CNBC: Iraqi troops seize parts of oil-rich Kurdish region that voted for independence

Iraqi army units on Sunday seized positions in and around Kirkuk, a major oil city that's dominated by the country's Kurdish people and which voted for independence last month. [more...]

CNBC: China stands at 'a new historic starting point,' Communist Party says

China is boasting of its growing economic and political development as the country comes to a standstill for the once-every-five-years Communist Party Congress. [more...]

CNBC: The IMF has a message for emerging markets: Take advantage of easy money while it lasts

Emerging markets should get their fiscal houses in order while monetary conditions remain loose, the International Monetary Fund warned. [more...] |

|

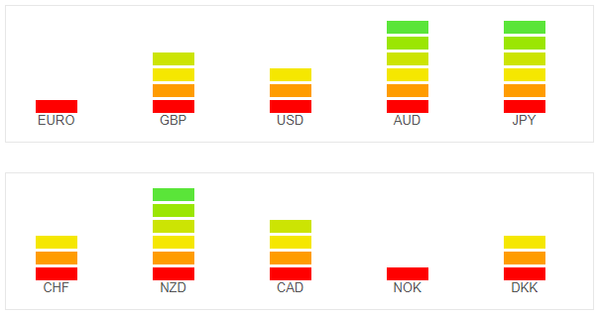

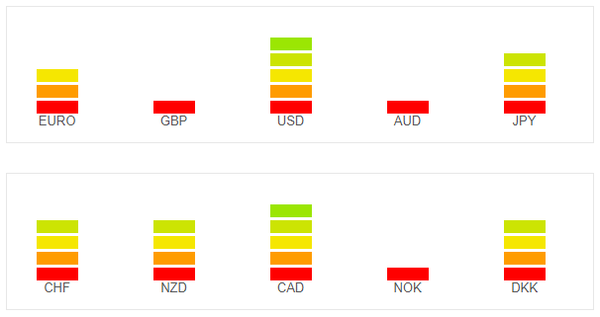

Currency Strength Indicators

|

|

Trade with the Trend! Join today by clicking below and know which way to trade by accessing our market directional signal!

Disclaimer Notice

Past performance is not indicative of future results. Trading stocks, options, forex, CFDs and equites carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts.

The information provided by Edvesting.com should not be relied upon as a substitute for extensive independent research which should be performed before making your investment decisions. Edvesting.com are merely providing this information for your general information. The information and opinions presented do not take into account any particular individual's investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision and should tailor the trade size and leverage of their trading to their personal risk appetite.

Edvesting.com and/or its owners will not be responsible for any losses incurred on investments made by readers and clients as a result of any information contained on Edvesting.com. Edvesting.com does not render investment, legal, accounting, tax, or other professional advice. If investment, legal, tax, or other expert assistance is required, the services of a competent professional should be sought.

Todays Markets

/0 Comments/in Day Trading Signals /by admin|

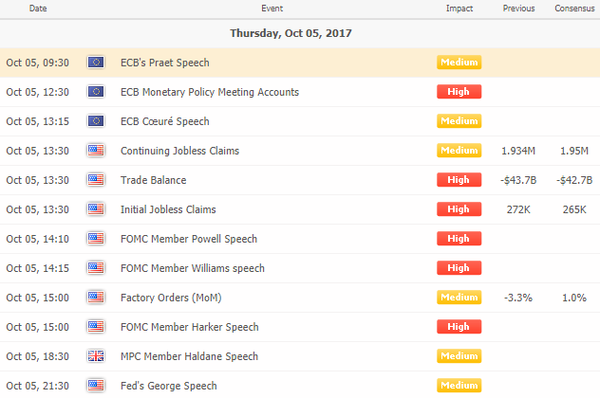

Economic Calendar

|

|

|

Trading Sentiment

Below is the latest sentiment as compiled by etoro, the world's largest (social) trading network. It provides a view of what individual investors think about the specific instruments and gives a view of the current sentiment.

|

|

|

Latest News Headlines

Bloomberg: Aussie Drops in Listless Asia Trading; Stocks Flat: Markets Wrap

A shock drop in Australian retail sales dragged the Aussie lower, one of the few moves in otherwise becalmed Asia-Pacific markets. Bonds, equities and the dollar were all steady after U.S. data did little to change views on the timing or pace for monetary tightening. [more...]

Bloomberg: Oil Drops Below $50 as Record U.S. Exports Seen Flooding Market

Oil slid below $50 a barrel for the first time in two weeks as a flood of U.S. crude reignited concerns over a global glut. [more...]

Bloomberg: Only One Major Asian Stock Market Has Shrunk This Decade

Australia’s economy has grown faster than its developed-world peers over the past decade, uniquely avoiding a recession. That means its stock market has grown handsomely too, right? [more...]

Bloomberg: Paulson Says Sprott, Others Keen to Join Gold-Investors Group

Paulson & Co.’s plan for a coalition of gold-mining company investors has gotten a better-than-expected response, with one major investor already on board and another likely to join, according to the hedge fund. [more...] Bloomberg: Dollar Drops Amid Narrow Ranges as Traders Await Next Drivers The dollar pared a second day of modest losses after a private-sector employment report came in as expected and a services industry gauge rose to a 12-year high. [more...]

Reuters: Asian shares edge up slightly after strong U.S. data

Asian shares were a tad firmer on Thursday, taking their cues from strong U.S. data although holiday-thinned trade and uncertainty about the impact of recent hurricanes on the U.S. economy are likely to keep investors cautious. [more...]

Reuters: U.S. budget deficit could obstruct Trump's tax cut plan

The U.S. budget deficit is proving to be a major obstacle to the tax reform plan being offered by President Donald Trump and top congressional Republicans, with one leading Senate hawk saying a week after the plan was introduced that any enlarging of the fiscal gap could kill his support. [more...]

Reuters: Oil stable on expectations of extended output cut, but U.S. crude exports drag

Oil prices were stable on Thursday on expectations that Saudi Arabia and Russia would extend production cuts, although record U.S. exports and the return of supply from a Libyan oilfield dragged on the market. [more...]

CNBC: Russia's energy minister says compliance for OPEC production cut is 'almost 100 percent'

The Organization of the Petroleum Exporting Countries has basically fully implemented an oil production cut, Russia Energy Minister Alexander Novak told CNBC. [more...]

CNBC: Asia mixed in afternoon trade — Australian retail sales record unexpected fall

Asia traded mixed on Thursday, with some Australian retailers faltering after lower-than-expected sales data showed consumers Down Under were cutting back. [more...]

CNBC: Russia denies that energy deals with Saudi Arabia are a threat to the US

The chief executive of Russia's sovereign wealth fund has denied that forming closer energy ties with Saudi Arabia is about politically sidelining Washington. [more...] |

|

Currency Strength Indicators

|

|

Trade with the Trend! Join today by clicking below and know which way to trade by accessing our market directional signal!

Disclaimer Notice

Past performance is not indicative of future results. Trading stocks, options, forex, CFDs and equites carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts.

The information provided by Edvesting.com should not be relied upon as a substitute for extensive independent research which should be performed before making your investment decisions. Edvesting.com are merely providing this information for your general information. The information and opinions presented do not take into account any particular individual's investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision and should tailor the trade size and leverage of their trading to their personal risk appetite.

Edvesting.com and/or its owners will not be responsible for any losses incurred on investments made by readers and clients as a result of any information contained on Edvesting.com. Edvesting.com does not render investment, legal, accounting, tax, or other professional advice. If investment, legal, tax, or other expert assistance is required, the services of a competent professional should be sought.

Follow Us!