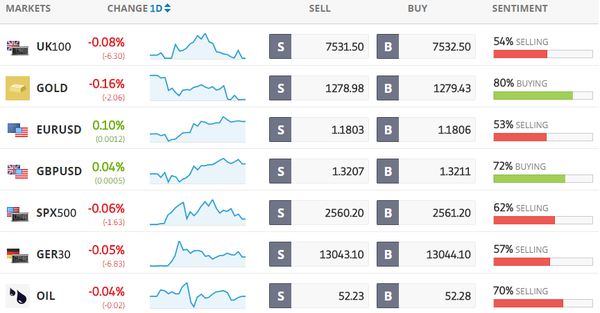

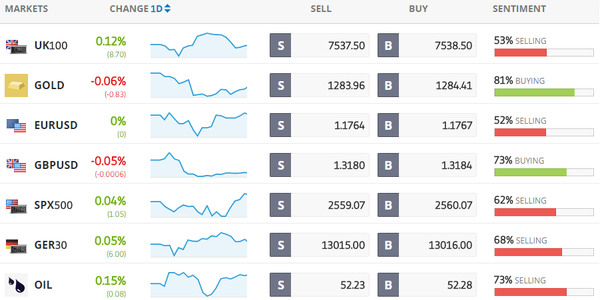

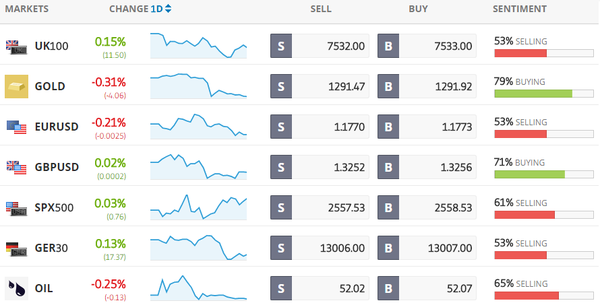

Todays Markets

|

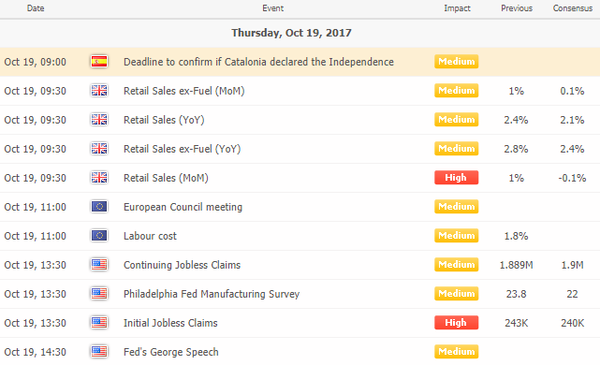

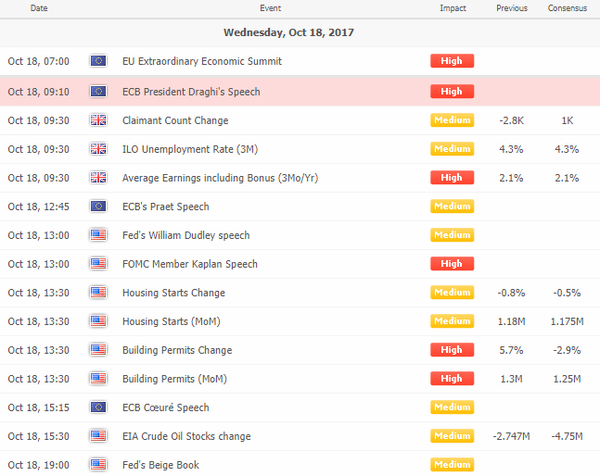

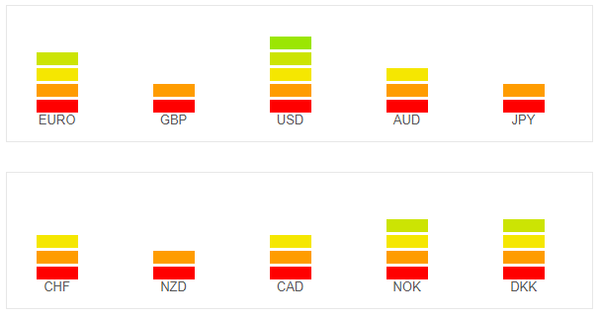

Economic Calendar

|

|

|

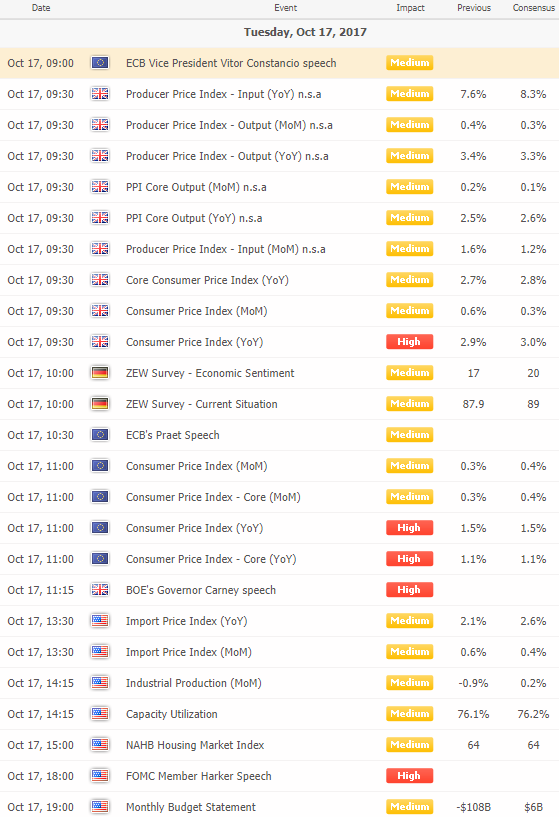

Trading Sentiment

Below is the latest sentiment as compiled by etoro, the world's largest (social) trading network. It provides a view of what individual investors think about the specific instruments and gives a view of the current sentiment.

|

|

|

Latest News Headlines

Bloomberg: Stocks Pause as Catalan Deadline Looms; Kiwi Sinks: Markets Wrap

Stocks meandered as investors shrugged off Chinese economic data that showed a solid pace of growth and as the clock ticked toward Catalonia’s Thursday deadline to give up claims to independence. The New Zealand dollar plunged after the Labour Party won support to form a new government. [more...] Bloomberg: Investors Ask Goldman Sachs How to Prepare for an Aussie Stock Sell-off

Betting against Australian stocks with weak momentum has been one of the most consistently profitable methods to profit from a market downturn, according to analysis from Goldman Sachs Group Inc. [more...] Bloomberg: China's Economic Growth Remains Intact as Party Leaders Meet

Robust factory output and consumer spending kept China’s economy humming in the third quarter, giving President Xi Jinping a firm footing to rein in excess capacity, curb pollution and shift to a more sustainable growth path. [more...] Bloomberg: Australian Jobless Rate Unexpectedly Drops on East-Coast Hiring

Australian unemployment unexpectedly dropped in September after a burst of hiring in the two most populous states. [more...] Reuters: Asia stocks shed gains after data shows slower China growth

Asian stocks shed early gains on Thursday, pulling back from decade highs, with Chinese equities leading the way lower after data showed growth in the world’s second largest economy slowed slightly in the third quarter. [more...] Reuters: Thirty years ago this week, Wall Street slid into the abyss

30 years ago the Dow Jones Industrial Average had lost 22.6 percent in one day, equivalent to a drop of about 5,200 points in the index today. The benchmark U.S. S&P 500 index plunged 20.5 percent on Black Monday, equal to a drop of over 520 points today, and the Nasdaq dropped 11.4 percent, comparable to a drop of about 750 points. [more...] CNBC: China reports 6.8% third-quarter GDP growth, meeting expectations

China reported third-quarter growth data Thursday that met expectations, but was a tad lower than the second quarter's 6.9 percent expansion. [more...] CNBC: China's central bank just warned of a sudden collapse in asset prices

China will fend off risks from excessive optimism that could lead to a "Minsky Moment," central bank governor Zhou Xiaochuan said on Thursday, adding that corporate debt levels are relatively high and household debt is rising too quickly. [more...]CNBC: London is the European hotspot for venture capitalists when it comes to fintech London remains the top European city for venture capital investment in financial technology firms, according to data released by Mayor Sadiq Khan's promotional agency. [more...] |

|

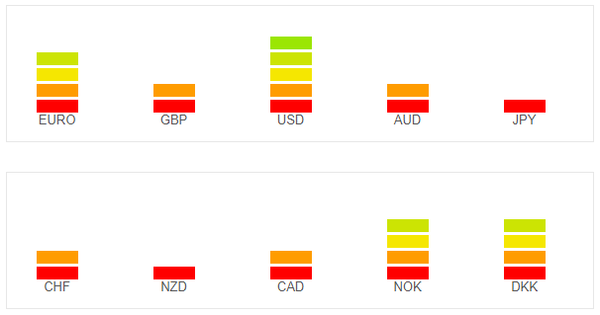

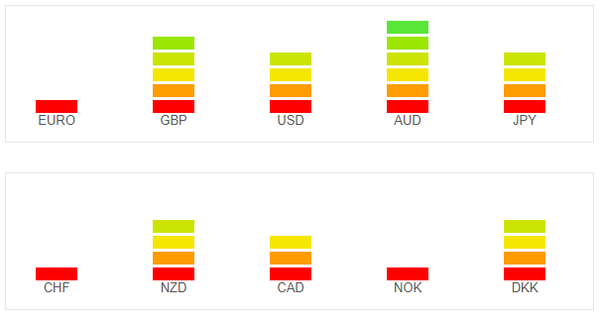

Currency Strength Indicators

|

|

Trade with the Trend! Join today by clicking below and know which way to trade by accessing our market directional signal!

Disclaimer Notice

Past performance is not indicative of future results. Trading stocks, options, forex, CFDs and equites carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts.

The information provided by Edvesting.com should not be relied upon as a substitute for extensive independent research which should be performed before making your investment decisions. Edvesting.com are merely providing this information for your general information. The information and opinions presented do not take into account any particular individual's investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision and should tailor the trade size and leverage of their trading to their personal risk appetite.

Edvesting.com and/or its owners will not be responsible for any losses incurred on investments made by readers and clients as a result of any information contained on Edvesting.com. Edvesting.com does not render investment, legal, accounting, tax, or other professional advice. If investment, legal, tax, or other expert assistance is required, the services of a competent professional should be sought.

Follow Us!