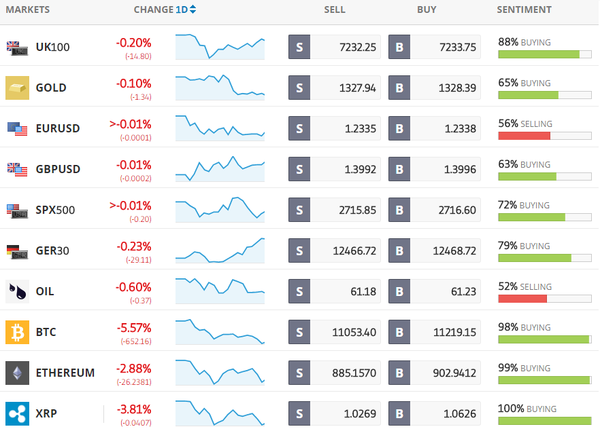

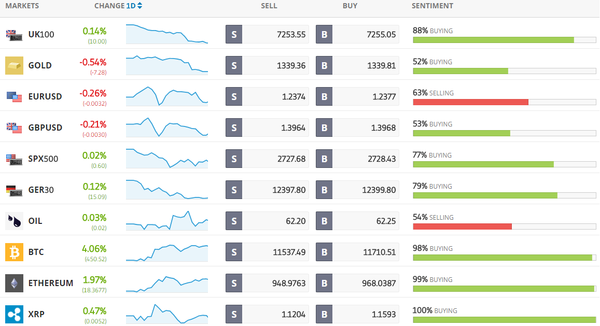

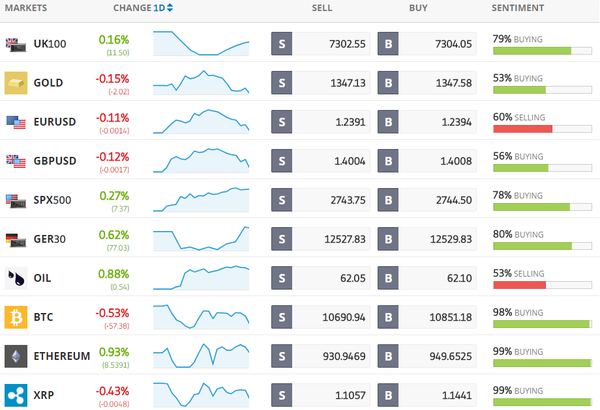

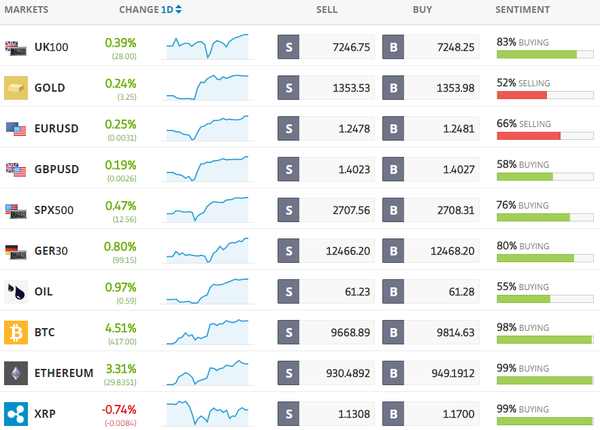

Todays Markets

|

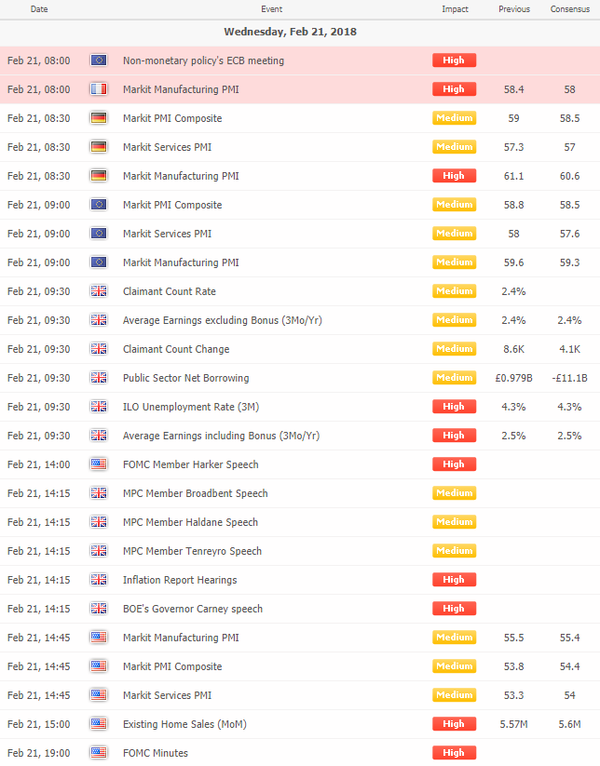

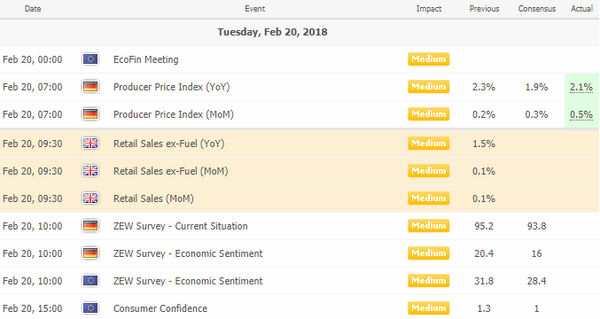

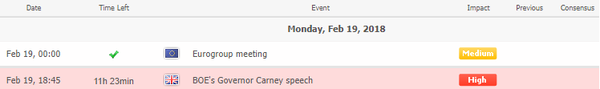

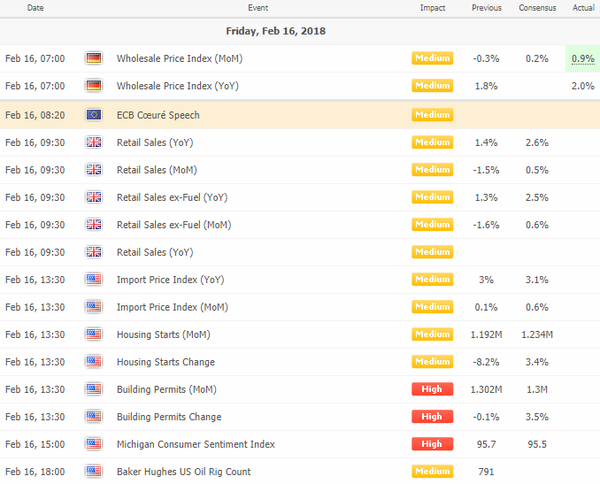

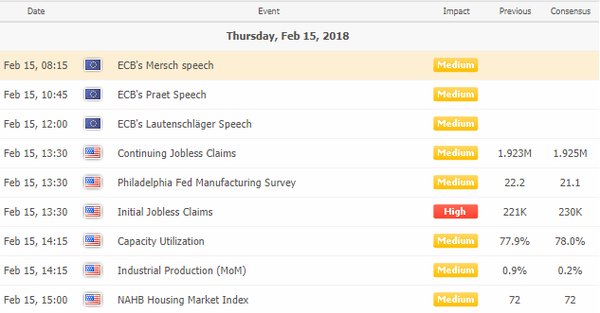

Economic Calendar

|

|

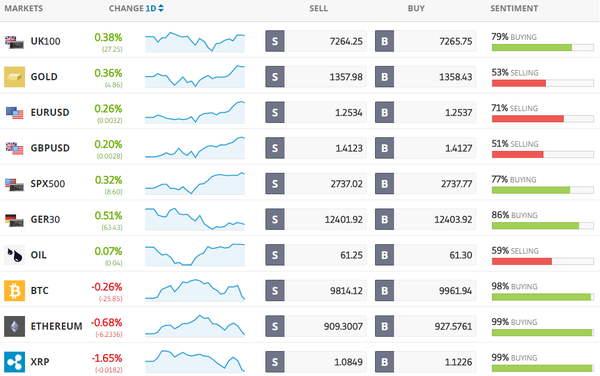

Trading Sentiment

Below is the latest sentiment as compiled by etoro, the world's largest (social) trading network. It provides a view of what individual investors think about the specific instruments and gives a view of the current sentiment.

|

|

Latest News Headlines

Bloomberg: Money Managers Think the Worst Is Yet to Come for S&P 500

About 57 percent of investors surveyed by Strategas Research Partners expect the S&P 500 Index to break the intraday low of 2,533 reached on Feb. 9, while the rest say the market has bottomed for the year after a two-week selloff sent the index to its first 10 percent correction since 2016. [more...]

Bloomberg: Short-End Treasuries Fall, Asia Stocks Fluctuate: Markets Wrap

Asian stocks meandered as U.S. equity futures pared gains while shorter-dated U.S. Treasuries extended declines amid a massive debt issuance. The dollar continued to strengthen. [more...]

Bloomberg: Goldman Debunks Idea Dollar Is Being Driven Down by U.S. Worries

Are worries about the twin U.S. deficits dragging down the greenback? Is it more about the Trump administration endorsing a weak-dollar policy? Not so, Goldman Sachs Group Inc. analysts say. [more...]

Bloomberg: ETF Veteran Goes Crypto, Predicting Multitrillion-Dollar Market

Matt Hougan is leaving the exchange-traded-fund industry after 15 years and going all-in on cryptocurrencies as he predicts digital assets will transform investments just like ETFs did. [more...]

Bloomberg: Apple in Talks to Buy Cobalt Directly From Miners

Apple Inc. is in talks to buy long-term supplies of cobalt directly from miners for the first time, according to people familiar with the matter, seeking to ensure it will have enough of the key battery ingredient amid industry fears of a shortage driven by the electric vehicle boom. [more...]

Bloomberg: Bitcoin Rises as South Korea Talks ‘Active’ Support for Trading

Bitcoin’s stunning rebound continued on Tuesday, with the world’s largest digital token extending February’s gains after South Korean regulators signaled they will actively support what they called “normal” cryptocurrency trading. [more...]

Bloomberg: New Favorite Way to Short the Dollar Has Yen Replacing Euro

The rally that’s made the yen 2018’s top performer among developed-market exchange rates will extend as speculators pick the Japanese currency over the euro to ride the U.S. dollar’s weakness, say analysts. [more...]

Reuters: Oil falls as dollar firms, U.S. oil output expected to rise

Oil prices fell on Wednesday, weighed down by a rebound in the U.S. dollar from three-year lows hit last week and an expected rise in U.S. oil production. [more...]

Reuters: Asian stocks gain, dollar extends recovery

Asian stocks gained on Wednesday, while the dollar advanced as traders near-term focus shifted to the minutes of the Federal Reserve’s last policy meeting for hints on the future pace of U.S. monetary tightening. [more...] |

|

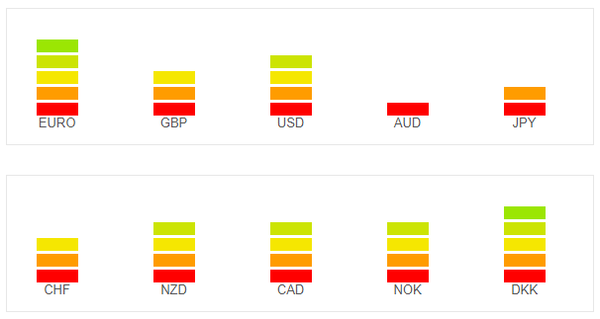

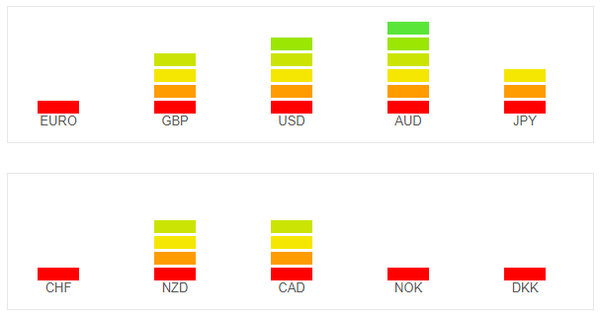

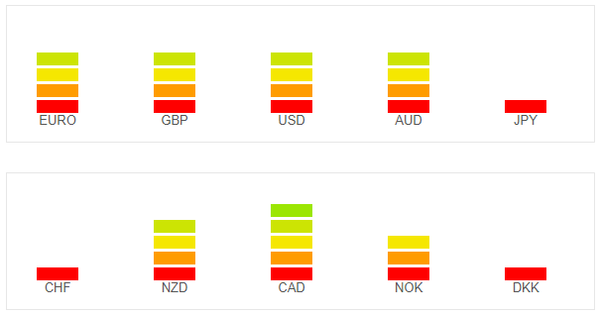

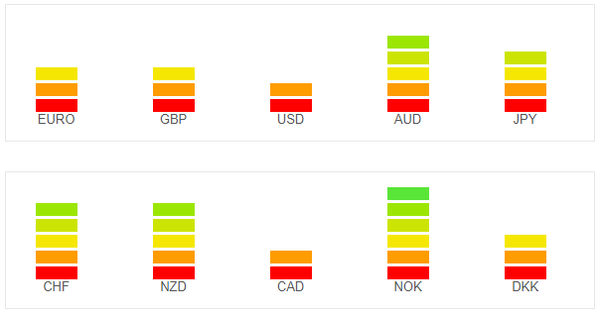

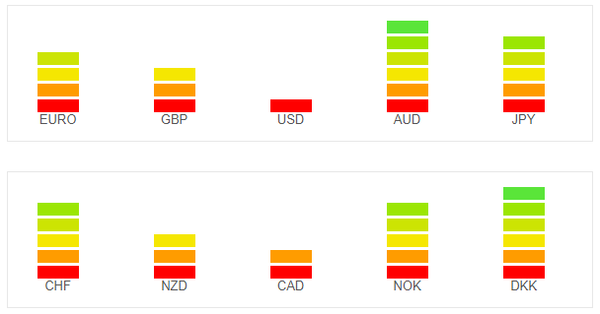

Currency Strength Indicators

|

|

The currency strength meter gives you a quick visual guide to which currencies are currently strong, and which ones are weak. The meter measures the strength of all forex cross pairs and applies calculations on them to determine the overall strength for each individual currency. For example, if EUR is strong and USD is weak, it could mean that the currency pair EURUSD could be going up. If both currencies are strong or weak it is better to avoid since it will probably means there is no clear direction for the specific pair. To get the latest Currency Strength Indicator please click here

Follow Us!