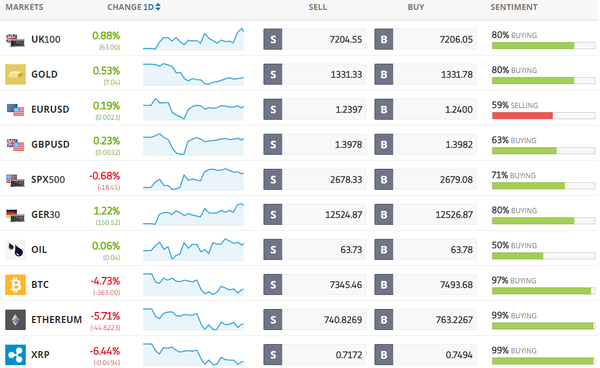

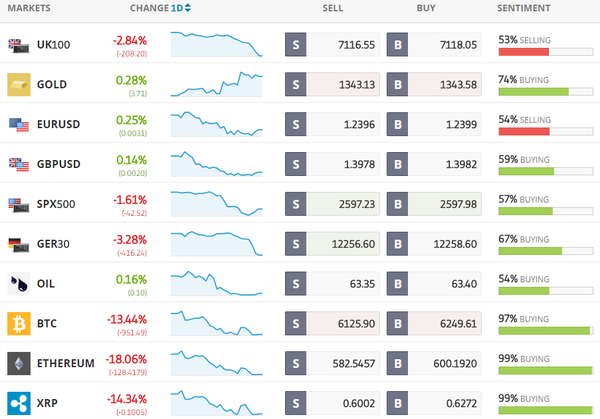

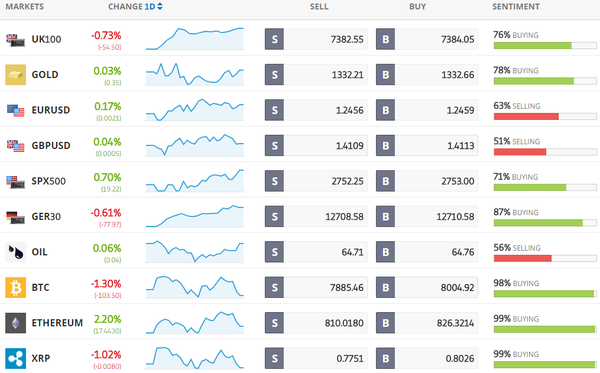

Todays Markets

|

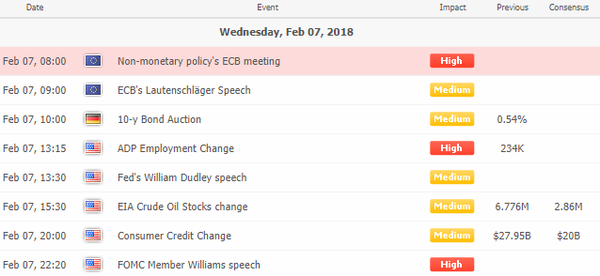

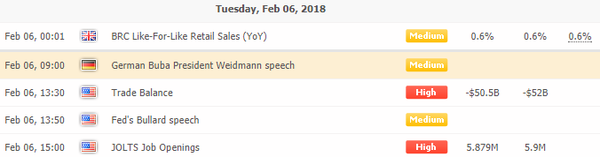

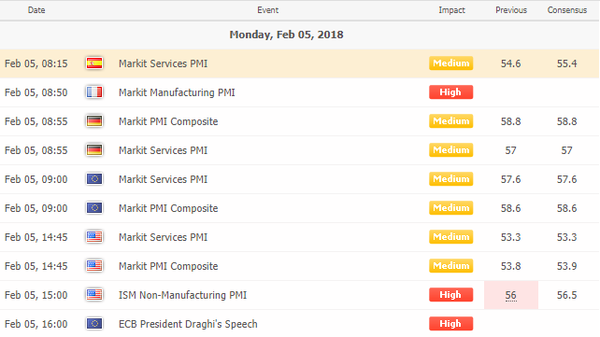

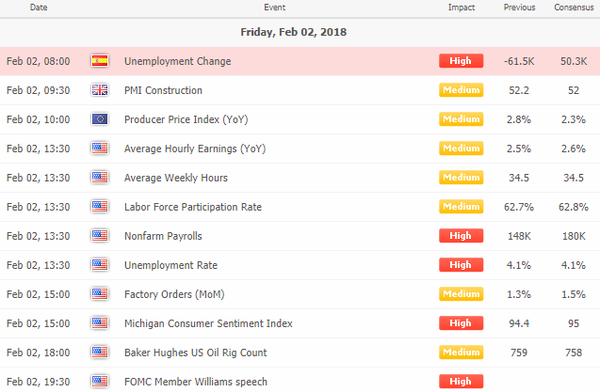

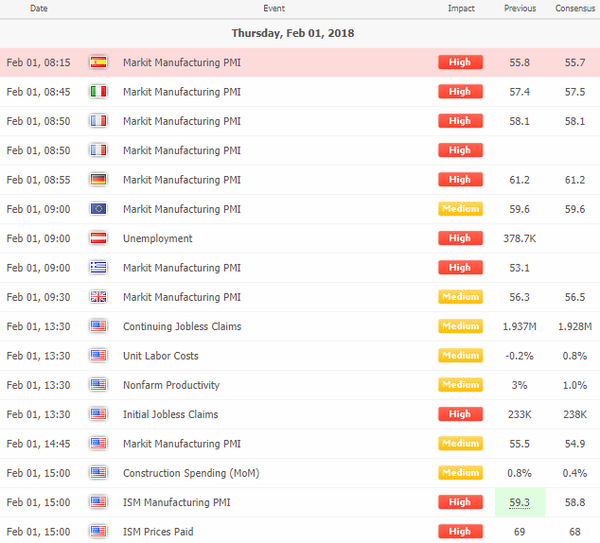

Economic Calendar

|

|

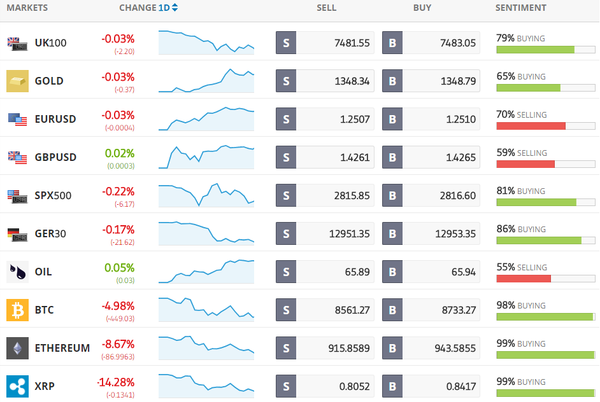

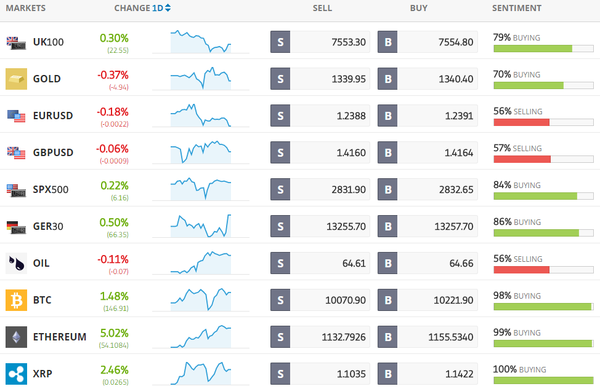

Trading Sentiment

Below is the latest sentiment as compiled by etoro, the world's largest (social) trading network. It provides a view of what individual investors think about the specific instruments and gives a view of the current sentiment.

|

|

Latest News Headlines

Bloomberg: Asian Stock Rebound Falters as U.S. Futures Drop: Markets Wrap

What promised to be a recovery in equity markets after the global rout faltered in Asia as U.S. stock-index futures declined. Treasury yields fell after spiking on Tuesday and the yen gained as investors turned back to haven assets. [more...]

Bloomberg: Buying the Dip Works Nicely, a 30-Year History of Routs Shows

As the dust settles for now after the turmoil of the last few days, a chorus of buy-the-dip calls from fund managers and strategists is still ringing in equity investors’ ears. History suggests they have a point. [more...]

Bloomberg: Trader Whose Fund Made $2.7 Billion in Crisis Says Volatility's Here to Stay

Stephen Diggle, who co-founded a hedge fund that made $2.7 billion in the depths of the global financial crisis, said the resurgence of volatility is here to stay as bonds and stocks are both way overvalued. [more...]

Bloomberg: ETFs Are Holding Up, Despite Volatility-Linked Trading Madness

Did two exchange-traded products lose more than $3 billion in value Monday? Yes. Is this the ETF-led meltdown everyone’s been warning about? [more...]

Bloomberg: Carl Icahn Says Market Turn Is ‘Rumbling’ of Earthquake Ahead

Carl Icahn says he expects stock markets to bounce back after the massive selloff Friday and Monday, while warning that current market volatility is a harbinger of things to come. [more...]

Bloomberg: Get Ready for Most Cryptocurrencies to Hit Zero, Goldman Says

The tumble in cryptocurrencies that erased nearly $500 billion of market value over the past month could get a lot worse, according to Goldman Sachs Group Inc.’s global head of investment research. [more...]

Bloomberg: Goldman's Schwartz Sees Buying Opportunity After Stock Rout

Goldman Sachs Group Inc. Co-President Harvey Schwartz is confident that stocks will bounce back from this month’s rout and welcomed efforts to bring interest rates back to normal. [more...]

Bloomberg: Bitcoin Snaps Slide as Crypto Markets Dodge Push for Regulation

Bitcoin rose for the first time in six days, snapping a losing streak that had helped push overall losses in digital currencies to about $500 billion, as the top U.S. market cops said they possessed all the authority needed to regulate and risk appetite returned to financial markets. [more...]

Reuters: Wall Street roars back, traders eye volatility ahead

Shaken out of many months of calm, Wall Street braced for a higher level of volatility in the days ahead, after a roughly 2 percent rebound in U.S. stocks on Tuesday followed the biggest one-day selloff in more than six years. [more...]

Reuters: Oil prices rise on report of lower U.S. crude inventories

Oil prices rose on Wednesday, lifted by a report that U.S. crude inventories fell last week, although analysts warned that soaring U.S. output and a seasonal demand drop could soon weigh on crude. [more...]

CNBC: Wall Street turned these esoteric 'ETNs' into a winning bet for the masses...and then they collapsed

The dramatic sell-off in stocks Friday and Monday forced a flood of buying in derivatives to close out on of Wall Street's biggest trades: while buying stocks, traders were betting against volatility, which has been near historic lows. [more...]

CNBC: Most Asia markets rebound after Wall Street's wild ride; China and South Korea lag

Most Asian markets advanced on Wednesday, retracing losses made in the last session, after major U.S. indexes finished their Tuesday session higher. [more...] |

|

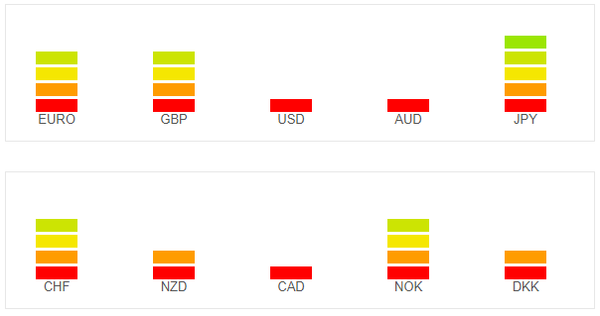

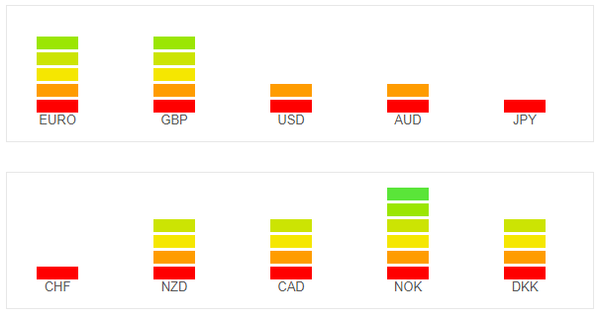

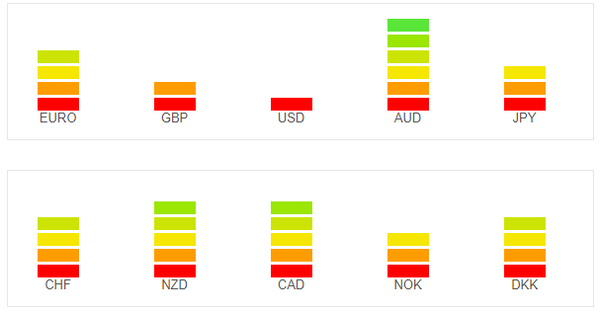

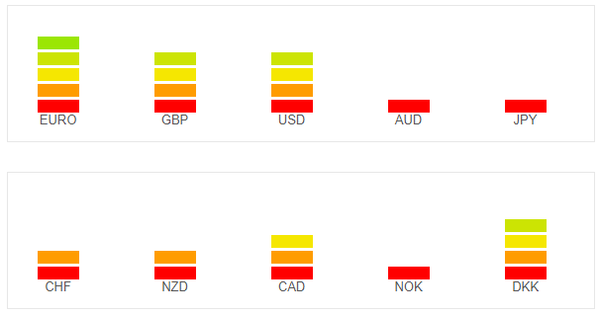

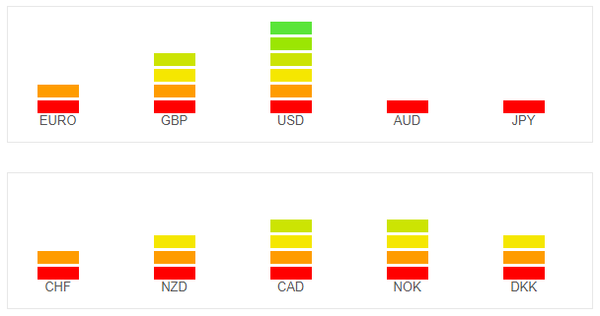

Currency Strength Indicators

|

|

The currency strength meter gives you a quick visual guide to which currencies are currently strong, and which ones are weak. The meter measures the strength of all forex cross pairs and applies calculations on them to determine the overall strength for each individual currency. For example, if EUR is strong and USD is weak, it could mean that the currency pair EURUSD could be going up. If both currencies are strong or weak it is better to avoid since it will probably means there is no clear direction for the specific pair. To get the latest Currency Strength Indicator please click here

Follow Us!